My nephew Camden and I were walking down the sidewalk on our way to a movie. At the same time, we both spied a shiny penny on the ground. Simultaneously, we both made a move for it. The youngster’s enthusiasm caused him to overshoot the coin. I easily snagged the penny and bragging rights to go with it.

As I held the penny up and obnoxiously gloated, my nephew shrugged his shoulders and said, “What’s the big deal, it’s only a penny?”

I responded, “So, you don’t think a penny is much, huh?” As such, I decided to have a little fun with Camden and teach him something valuable about math and compound interest.

I asked Camden if he would prefer $1 million today. Or, he could have one penny, but I would double it every day for a month.

Camden looked at me like I had lost my mind. The offer of $1 million seemed too good to pass on.

To make matters more fun, I told Camden that if he chose the lesser one, he would have to pay for our movie. Now that there was real money on the line he started to pay attention.

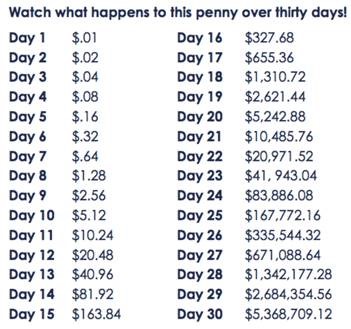

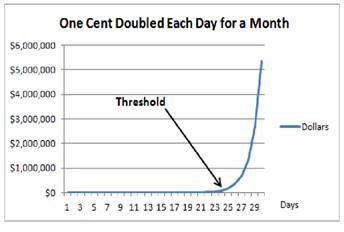

To help my nephew, we ran through the math of each day. In the first 10 days, he was convinced the million up front was the easy winner.

After ten days, the doubled penny had grown to $5.12. Camden remained confident that the million dollars was the better choice. However, I reminded him the marathon wasn’t over.

After 20 days Camden was surprised as to how much the penny had grown to. That one cent had now increased to $5,242. However, he still thought the cash up front was the right choice.

Twenty-five days in, the penny had grown to $167,772 and after 30 days Camden was shocked to see that a penny doubled every day for 30 days grew to more than $5 million.

This was a good lesson to teach Camden about the power of compound interest.

I then asked the boy wonder if he knew the Rule of 72. He painfully rolled his eyes and said “no.”

I told him I use this rule to calculate compound interest in my head. If you divide 72 by your annual return, it tells you how long it takes to double your money.

As such, 72 divided by 7.2% interest, tells us that money doubles every ten years.

At 10% interest, money doubles every 7.2 years and at 15% interest, money doubles every 4.8 years.

If you operate in the rarified air of Warren Buffett, you compound at 20% per year. This doubles money every 3.6 years.

The discussion with the budding scholar made a few points that are valuable for everyone.

- It takes time to accumulate large dollars. Even if compounding at a generous rate, it takes a while to get going. Warren Buffett started investing at age 11. Although Buffett is worth more than $88 billion today, he earned more than 99% of it after age 50.

- Because you can earn interest on your interest, compound interest accumulates geometrically. No wonder Einstein referred to compound interest as the “eighth wonder of the world.”

- To supercharge the compounding effect, save and invest consistently. If the financial markets drop, have the discipline to increase your investment. Being patient, consistent and disciplined is far easier and productive than trying to time the market.

- Taxes can be optional. Maximize compounding inside of IRA’s and 401k’s where the growth is tax deferred or possibly tax exempt. Even if investing in a taxable account, paying taxes can be managed. The capital gains tax is not a tax on gains, but rather a tax on the transaction of selling. As such, the wiser your decisions are the longer you can leave them alone and put off the tax man. This enhances your compounding.

My nephew learned quite a bit about growing wealth and compound interest. However, he has yet to pay up on buying my movie.