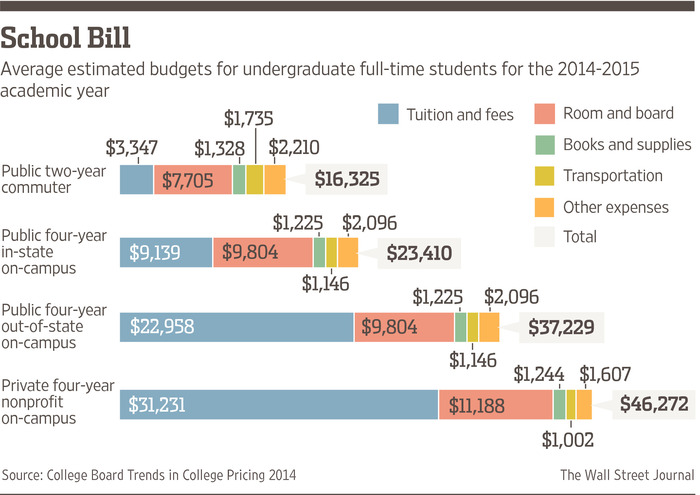

The challenges of paying for higher education are overwhelming. According to the College Board Trends in College Pricing for 2014 the public school cost for tuition, room, board, books and associated expenses is more than $23,000 per year. The all-in cost at a private school is more than $46,000 per year, on average. Whether technical or traditional school, private or public—higher education is an expensive endeavor.

However, it’s like eating an elephant…best accomplished one bite at a time.

In our family, it was not a matter of “if” we’d go to college—but rather “where”. Our parents were first generation college graduates and they were determined to make sure that option was open to us.

This did not happen by luck or randomness. There was a vision and diligence from early on which ultimately put me through a master’s degree.

Growing up, half of money given for birthdays or Christmas went into education savings. Additionally, once we started working part time jobs in high school, a portion of each check went into our education fund.

This accomplished two things. First, money was invested towards the goal. Secondly, it communicated that saving for education was not only important, but required.

These contributions helped offset some of the monumental expense and achieved “buy-in.” Although I never missed a party in college—I never missed class either. I was paying to be there and wanted my money’s worth.

Given this background, I was proud of my brother when he circulated his kids’ Christmas “wish list.” He said they didn’t need another toy. Instead, they needed help with educational expenses and encouraged everyone to contribute.

My brother’s mentality is similar to the one Carol and I have. Although we have no children, we have eleven Godchildren, nieces and nephews. None get lavish gifts. Instead, the vast bulk (90%) of any gift they receive goes into their education fund.

If everyone pitches in it is rather easy to do. If family and friends unite in funding $100 each month for education, and those funds grow at 8% per year, then $48,000 will be saved up after eighteen years.

Assuming you are a bit more serious and the “friends and family” plan contributes $250 each month, your future academic all-star will have a stout $120,000 saved up to tackle educational needs.

And if you are really successful and accumulate $500 every month then $240,000 in college savings after 18 years is quite possible.

The point is to start early, contribute regularly and achieve “buy-in” from all parties that this matters.

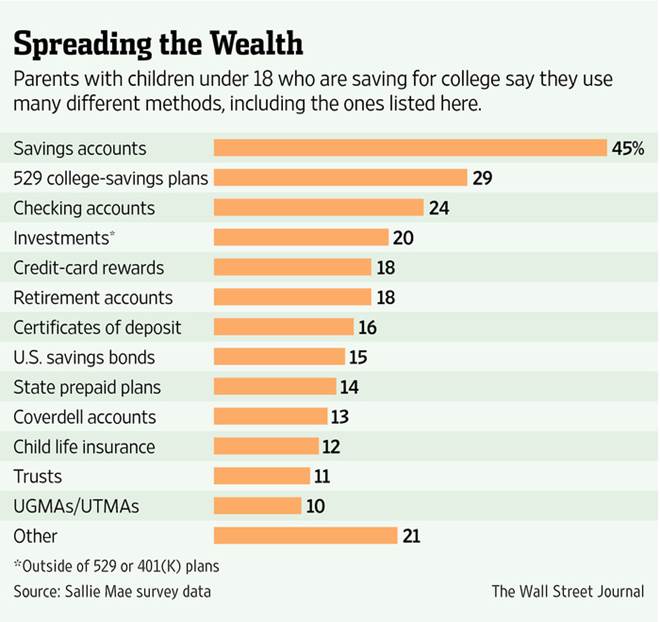

Next, it is important to know “where” to save.

First, consider a Coverdell Education Savings Account (ESA). Although contributions are limited to $2,000 per year the earnings can be tax exempt if used for qualified education expenses. Fully funding this account can produce $75,000 after 18 years.

After fully exhausting an ESA, look to the widely marketed 529 plan. Despite their popularity, we recommend a bit of caution.

The 529 plan allows for much larger contributions, which is great if a wealthy family member has $240,000 burning a hole in their pocket. The 529 earnings can be tax-exempt if used for qualifying expenses. However, there are more limitations on what is a qualifying expense when compared to an ESA.

Furthermore, while an ESA has thousands of investment choices available, the 529 is state sponsored. As such, each state has their pre-packaged bundle of investment choices. Some are good, while others are expensive and mediocre. Even if you are a resident of Texas, you can still invest in the 529 plan sponsored by Utah. As such, it pays to shop around.

If you have maximized contributions to an ESA and 529, many parents will then turn to a custodial account in the child’s name with the parent as custodian. Again, a word of caution is encouragedy. When funding a custodial account there are no tax deductions or exemptions, but your investment choices are unlimited and the funds can be spent on anything.

However, recognize that once the child turns the age of majority (no later than 21) whatever funds are in that account becomes their property to use however they wish. As such, from a control perspective it might be best to keep those funds in mom and dad’s name and distribute on an “as needed” basis.

Dave Sather is a Victoria certified financial planner and owner of Sather Financial Group. His column, Money Matters, publishes every other week.