As Vernon opened the door there was a sternness on his face. It was not a social visit, it was all business.

The Chinese had just devalued their currency and the Dow was down 250 points.

Making Vernon’s tension worse, he had seen a partial clip of Ron Paul talking about a future currency crisis in the U.S. and that the dollar would soon be worthless.

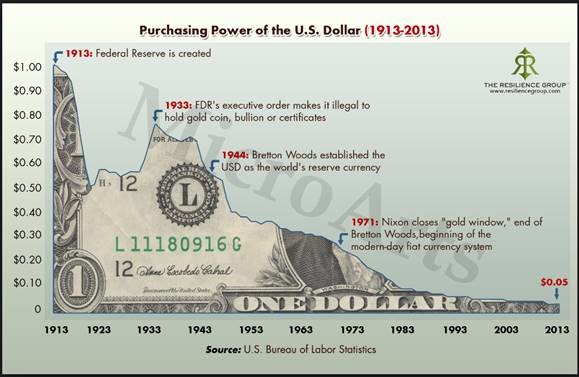

Sitting in the conference room, Vernon looked up from his coffee and said, “Do you realize that since the Federal Reserve was created in 1913 the U.S. dollar has lost more than 90 percent of its purchasing power?”

Vernon added that since 2008 the U.S. money supply has increased by 400 percent.

Both were true statements and held in isolation it is easy to see how it would be concerning to anyone. Either way, he knew his purchasing power was under attack.

Vernon added that since 1913 gold had increased from $20 per ounce to more than $1,100 today. After making this statement he wanted to know if he should liquidate his portfolio and load up on gold.

After a few minutes of venting, he relaxed a bit. It led to a productive conversation based on fact and not just salesmanship.

Much of Vernon’s information came from Stansberry Research – a company Paul now works for as a paid spokesman. Stansberry Research is effective in drumming up concern, so people will subscribe to their service. As such, Paul should not be viewed as a kindly public servant. He is paid to share his thoughts and therefore may have conflicts of interest.

We agreed with Vernon on the devaluation of the U.S. dollar, but pointed out that this phenomenon is not unique to just U.S. currency.

After making this distinction, it was a good opportunity to point out that although cash gives us flexibility, it is a horrible investment. The saying “Cash is king” is true to an extent. It offers liquidity to buy goods and services now. However, over long periods of time, cash currency from any nation generally loses value.

Vernon smiled as it confirmed his theories on the dollar.

Unfortunately, just because the dollar is a bad long-term investment does not mean gold is a good long-term investment.

As we discussed this, Vernon was puzzled. He reminded me that I agreed with his analysis. His math was correct. Gold had increased from $20 to more than $1,100 today.

However, I asked Vernon a thought provoking question, “What is the inflation adjusted rate of return for gold?”

Vernon processed the question but didn’t answer.

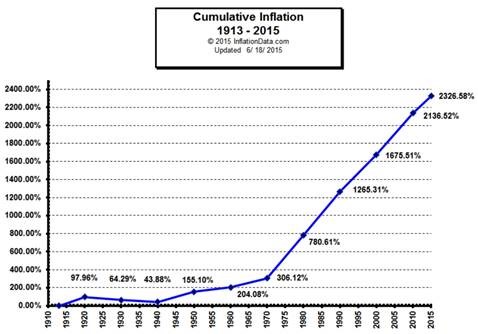

Since 1913 inflation has caused goods and services to increase in price by more than 2,300 percent. The point in bringing this up was that although gold increased, it produced less than a 1 percent annual return, when adjusted for inflation.

We also pointed out that gold does not produce any cash flow, it has to be securely stored, must be authenticated and cannot be used as money.

Vernon leaned back in his chair and said, “OK, so cash is trash and gold is a big paperweight. What suggestions do you have smart guy?”

I replied that if we are long-term investors, we prefer stock market assets – especially multi-national companies – for a couple of reasons.

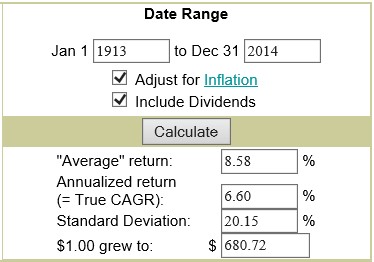

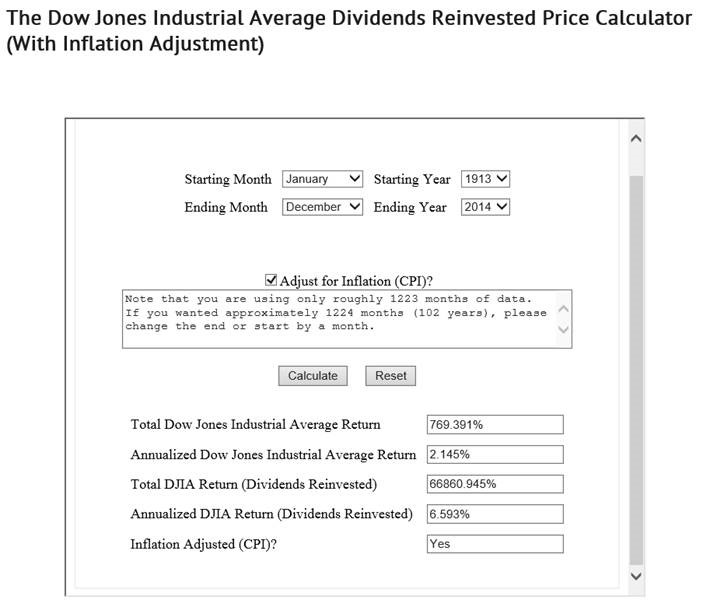

Since 1913 the stock market has produced total returns of 8.5 percent per year- but 6.6 percent per year adjusted for inflation. Although stocks offer a bumpy ride they offer the best long-term inflation adjusted returns.

Furthermore, 40 percent of the profits earned by the companies in the S&P 500 are derived outside the U.S. As such, this serves as a hedge against devaluation of the U.S. dollar, or any other single currency.

Furthermore, at a time when interest rates remain at generational lows, well established companies usually pay dividends. Dividends help many investors manage cash flow needs. Historically, about 40 percent of the total return of the stock market has come from dividends.

As Vernon finished his coffee he recognized there is no perfect investment – they all have their trade-offs and periods of scary headlines. Instead, he recognized the need to use cash for short term liquidity while embracing the volatility associated with stocks in an attempt to maintain purchasing power and produce cash flow during his retirement.

Dave Sather is a Victoria Certified Financial Planner and owner of Sather Financial Group. His column, Money Matters, publishes every other week.