Financial Management In A Coronavirus World

If you listen to the news, the latest on the coronavirus will curl your toes. You are left with the impression that the grim reaper is around the corner.

Amidst the swirling headlines one of our favorite clients called. Joe expressed his concern saying the market was down 550 points and the word “pandemic” is being thrown around. He asked, “Just how bad do you think this is going to get and what moves should be made regarding my portfolio?”

Certainly, death and illness are serious topics. However, things like this happen.

As we grabbed a cup of coffee, Joe said there were now more than 10,000 cases of the coronavirus and 200 deaths. These illnesses exceeded the total number of SARS cases during the 2002 – 2003 epidemic.

As the recent retiree stared at his coffee, he wondered if he should liquidate his portfolio. He wanted reassurance on his plan.

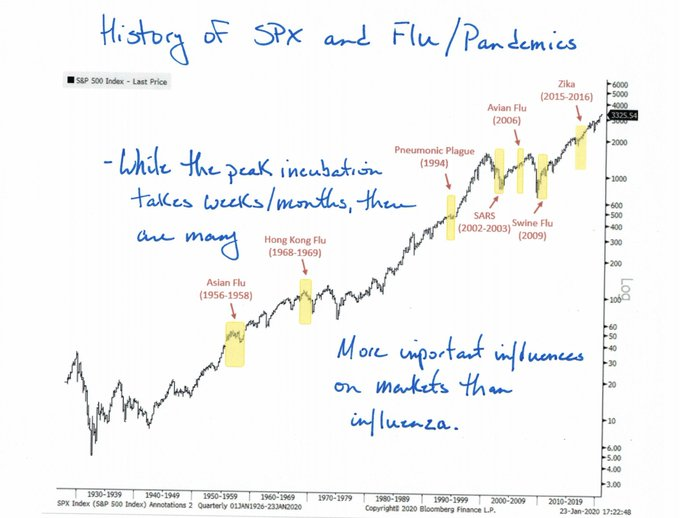

First, we offered some perspective. Over the last sixty-five years the world has endured the Asian Flu (1956 – 58), Hong Kong Flu (1968 – 69), Pneumonic Plague (1994), SARS (2002-03), Avian Flu (2006), Swine Flu (2009) and Zika (2015–16).

In each case, the financial markets took a step back before returning to a long-term upward trajectory.

Joe had battled the flu last year. As such, I asked him how many people contracted the flu.

Surprisingly, about 15 million people have had the flu in 2020 resulting in more than 8,000 deaths. Furthermore, according to the World Health Organization the flu kills more than 600,000 people per year worldwide.

I shared this with Joe not to diminish the seriousness of the coronavirus, but rather to point out that we deal with things this serious on a regular basis. And yet, we still make progress.

Joe countered that Nike, Google and Starbucks have shut many offices in China. Airlines and hotels were cutting back and oil was dropping. This is all true. If I ran any of those businesses, I would curtail my directly exposed operations too. The cutbacks will lower earnings on a temporary basis; however, they will survive.

Next, I showed the jittery client a report from the 2019 Global Health Security Index which revealed the United States is the best prepared country in the world in terms of dealing with an outbreak of disease.

This eased Joe a little. I then asked if he planned on taking a trip to China anytime soon. He emphatically replied, “No!”

The odds of Joe or his family getting sick are statistically quite remote. Once we determined Joe’s life was not in imminent danger, we discussed how his portfolio was built and why it matters.

Much of successful investing comes from being emotionally disciplined. Very little of what we deal with requires higher order math or genius level decisions.

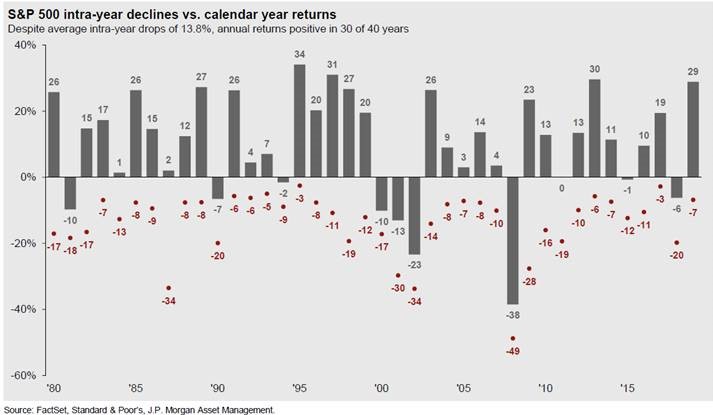

The stock market has increased 30 out of the past 40 years producing double digit returns. However, in just the average year the stock market will fall by 14% intra-year. As such, you must prepare for a bumpy ride to derive the long-term averages.

Obviously, when Joe retired, he no longer had a regular paycheck. As such, we built a cash cushion to insulate his portfolio and reduce volatility. This cushion would pay his bills for the next nine months, allowing him to sleep at night.

We evaluated increasing his cash cushion. Joe realized this served a short-term purpose, but it would not outpace long-term taxes and inflation.

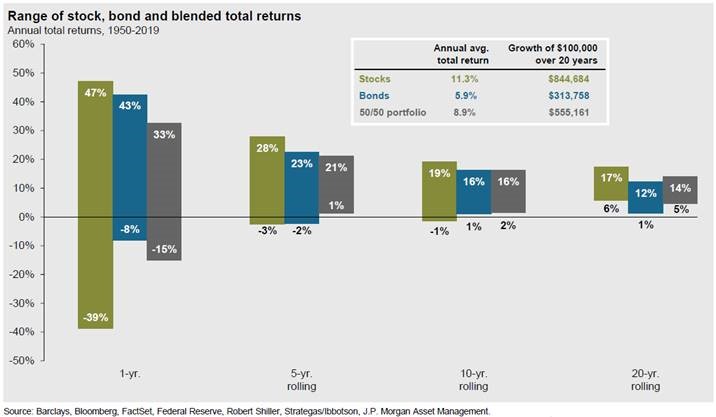

Next, we discussed the fact that Joe owned a balanced portfolio of growth and income producing assets. This blend of assets allowed the retiree the potential of earning nearly as much as an all-stock portfolio, but not nearly the downward volatility. Over the last seventy years a blend of half stocks and half fixed income has never produced a negative return after a five year holding period.

Joe also knew to limit withdrawals to 3% of his portfolios market value.

This allowed Joe to supplement his retirement income needs, while reinvesting the balance such that his portfolio has an opportunity to maintain its purchasing power.

After running through the math and statistics, Joe realized this simple plan allowed him safety, cash flow and opportunity for long-term growth. It also allowed him to not worry about the impact from scary world events.

Dave Sather is a Certified Financial Planner™ and owner of Sather Financial Group. His column, Money Matters, publishes every other week.