Investing & Things Beyond Your Control

With COVID-19 disrupting our world for more than a year, peoples’ frustrations seem to be getting the best of them. Many comments, if not controlled, will negatively impact your investments.

Six particular concerns have been voiced repeatedly to us.

1. I’m not happy with the Presidential or Congressional elections.

Investments don’t care what your political leanings are. Regardless of election outcomes, business owners continue to give their best effort at capitalism and entrepreneurship. As such, investments must be logically and thoughtfully managed.

2. Taxes must go up to lower the deficit.

Although we can’t run our personal households with never-ending deficits, governments can do so for extended periods. Governments play by a different set of rules that defy logic. Just when you think deficits cannot get any larger, we’ll have another spending program.

I wouldn’t hold my breath waiting for a politician to embrace fiscal discipline. Politicians will say many things while running for office (which is always). The more outrageous the proposal, the bigger the soundbite. However, the more extreme, the less likely it is to become policy.

Furthermore, taxes may impact rates of return, but they generally don’t determine if an asset is a good investment.

For individuals, even at the highest tax rates, investors keep the majority of realized gains. If investing in a taxable account, you can defer taxation by making good decisions and holding them for years, if not decades. Remember, the capital gains tax is not a tax on gains, but rather a tax on the transaction of selling. Be patient and very long-term focused.

3. Inflation is sure to go up.

Anyone who remembers Jimmy Carter immediately recalls inflation and 15% interest rates. Inflation is currently very modest at 2%. We have a long way to go before we match the high-water mark of the Carter Administration.

Pockets of inflation have been observed in used cars, healthcare and housing. However, technology, which is an ever-increasing chunk of the economy, is actually deflationary. Some inflation is generally a good thing for the broad economy.

4. The Federal Reserve must raise interest rates.

Don’t expect the Fed to push for higher rates. Higher rates result in higher interest paid on the national debt. Neither the Fed nor Treasury want that. With interest rates at record lows worldwide, there is no pressure on the Fed to react. You can almost be guaranteed the Fed will continue to push for accommodative rates.

5. The U.S. Dollar is going to devalue.

Well, there is not much room to argue here. The dollar will continue to lose its purchasing power. It may remain the world’s reserve currency, but that does not mean the dollar is a good store of value. In fact, while the dollar offers tremendous daily liquidity world-wide, it is a terrible asset to hold long-term.

6. The stock market is going to crash.

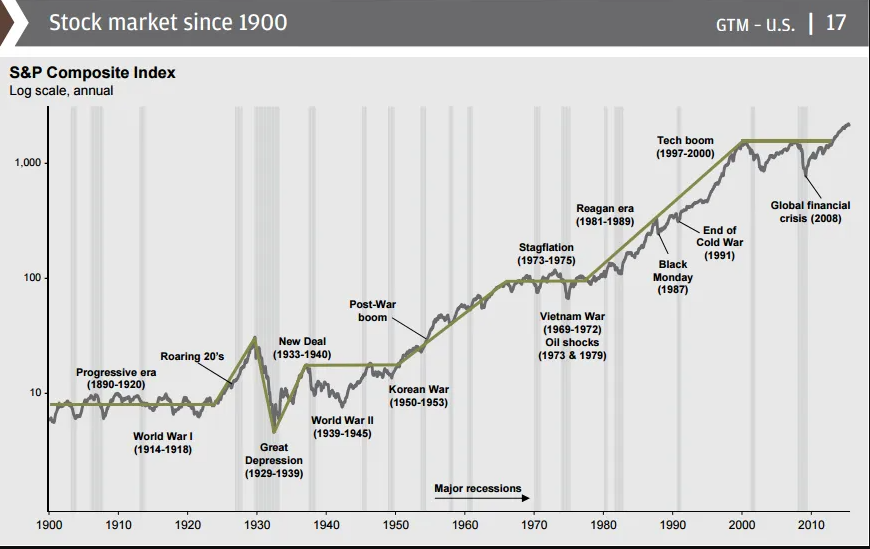

I’m sure the market will crash at some point. However, what is your definition of “crash?” If I told you the market would fall by 14% in the next twelve months, would you consider this a crash? An average, the market declines intra-year by 13.8%. Despite this, it has still delivered positive returns in 30 out of the last 40 years.

The stock markets remain very volatile over short-time frames. We will continue to endure war, recessions, floods, hurricanes, ice storms, pandemics, inflation, taxes and deficits. And yet, the long-term investor will be rewarded with positive stock market gains.

As we go forward, many scary sounding things may happen. We may incur changes in political administrations, interest rates, inflation, taxes, the dollar or the stock market. However, very few will happen and predicting their impact upon the markets is even harder.

I certainly don’t know what is going to happen and neither does anyone else. However, I am not sure it matters. None of this is within your control. As such, take a step back and determine what is within your control.

You determine where you live and where you work. You determine how you spend your money. And most importantly, you determine how to invest your money.

Have a plan that allows you to make calm, rational and well-researched decisions. Know what is beyond your control. Regardless of the catastrophes and calamities awaiting us, you still must manage your money and make it grow.

Dave Sather is a Certified Financial Planner and the president of the Sather Financial Group, a fee-only investment management and strategic planning firm.