A family friend, Darryl, started his first “big boy” job last summer. At the time, he called seeking advice on his 401(k)-retirement plan. To his credit, he jumped in with both feet. He was contributing 10% of pay and collecting his employers 6% match.

Several times Darryl bragged about how great his investment picks were doing. It remains to be seen whether Darryl is confusing genius with a strong bull market, but at least he was participating.

Since the first of the year, Darryl has seen his savings drop by 7% along with the market. Now, an agitated Darryl called wanting to know if he should get out “for a while.”

This is a typical conversation we have virtually every year with a variety of clients.

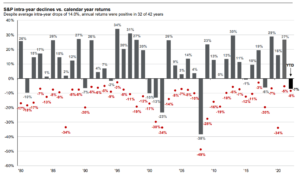

Volatility is simply part of the investing game. Since 1980 the stock market has dropped an average of 14% from its peak just during the average year and nearly two-thirds of the time, the market drops by 10%. Despite this, the stock market has produced positive returns in 32 out of 42 years.

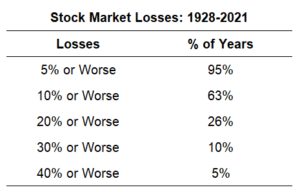

So many investors are convinced the “big one” is right around the corner. However, a 30% decline only happens about once every ten years and a 40% decline only happens once every 20 years. Despite these occasional bouts with volatility, we are still here and still making progress.

Darryl asked why the market is so erratic and again wondered if he should get out and “jump back in” when things settle down.

Unfortunately, the market never sends you a note saying, “It’s all clear now.” If you time the market not only must you accurately guess when to get out, but you must also accurately time when to get back in. It is so much easier to stay invested for the long-term.

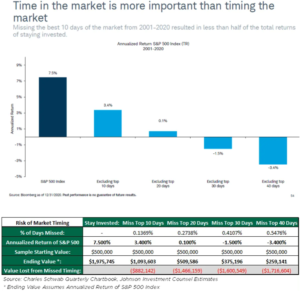

Investors have driven themselves mad trying to time the markets. We have never seen someone who can consistently time when to get in or out of the market. Between 2001 and 2020, the S&P 500 has averaged 7.5% per year.

However, if someone attempted to jump in and out and missed only the ten best days in the process, their return plummeted to 3.4%. Missing just the best 20 days over that twenty-year period lowered returns to nearly breakeven.

Additionally, if putting money into the market, lower prices should be welcome as you dollar-cost average in. If your employer offers a match, it is free money. It is pretty crazy not to participate in free money.

It is also important to recognize that stock markets do not offer fair or logical valuation mechanisms. Rather, they offer immediate liquidity. Sometimes you get liquidity at attractive prices while other times you may not. It pays to be patient as long-term returns are far more logical and reflect the underlying fundamentals and earnings of a business.

As we discussed this, Darryl observed that from January 5 through January 24, the Dow Jones Industrial Average fell right at 10%. And then, over the next seven days the market jumped more than 5%. He also noticed that the market is above where it was just a few months ago.

He wanted to know what had changed.

It is still the same market. Not much changed in one week or even a couple of months. This is just what happens over very short time frames.

Instead, we encouraged Darryl to play a game the average investor can win. If everyone else is hyper-obsessed with daily, weekly or monthly price movements, focus on where you want to be in ten or more years. The Wall Street gang is madly running in circles like crazy ants. At the same time, smart investors calmly focus on long-term business fundamentals.

The long-term investor emphasizes investments with rock-solid business models that treat customers well. Businesses with that customer-centric focus will enhance value for customers and shareholders over decades. It also allows investors to tune out short-term noise while remaining calm and logical.

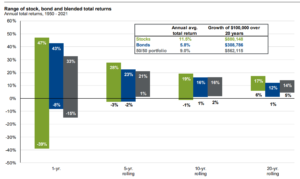

Short-term investing has always been a rough ride. However, the longer you invest, the smoother the returns become. Blending stock market assets with fixed income assets also serves to moderate volatility while offering long-term growth.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only strategic planning and investment management firm.