With oil prices spiking above $100 per barrel, certain elected leaders are making bold statements such as, “to the oil and gas companies…its no time for profiteering or price gouging.”

As such, politicians are proposing to create a new 50% tax on large oil companies. Supposedly, tax proceeds would be returned to lower-end consumers. The 50% rate would apply to companies with more than 300,000 barrels per day produced in, or imported to, the US. It is a “top line” tax calculated as the difference between the average price of Brent oil from 2015-2019 and the current price.

The tax would reduce profits for the large integrated companies like Exxon, Chevron, Pioneer, Devon, Marathon and Conoco.

This is straight out of the feelgood tales of Robinhood. Unfortunately, the proposed tax will only make matters worse. Before we go down this road, here are a few key issues to ponder.

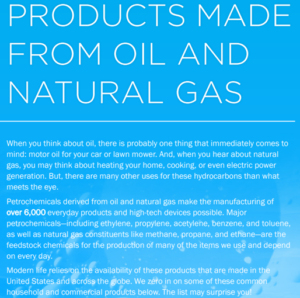

The oil and gas industry is critical to the nations survival. Yes, we use oil in the production of gasoline. However, there are more than 6,000 products made from oil and gas that we rely on daily. Unless you are willing to give up modern travel, plastic, paint, pharmaceuticals, telephones or soap, we should hold off on a boycott of the industry.

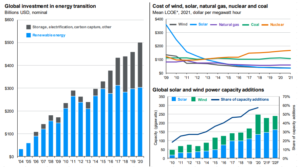

Many argue that driving electric cars can solve this riddle. It’s a nice goal, but it will not happen any time soon. In 2021, about 4.1 trillion kilowatts of electricity were generated at U.S. electricity generation facilities. About 61% of this electricity was from fossil fuels—coal, natural gas and petroleum. Nuclear energy was 19% and about 20% was from renewable sources. On average, that means that 61% of electric cars are powered by fossil fuels.

Understanding this, we ask oil companies to spend millions drilling a well not knowing if it’s a dry hole. That is real money put at risk. Based upon research conducted by the Energy Information Agency in 2016, wells in the Permian Basin can easily run $7 million a pop. That is a sizable commitment that is often forgotten when we pull up to our favorite pump to fill our cars.

Oil is a finite resource, but the world wants more of it every year. According to OPEC, world oil demand is expected to rise by 4.15 million barrels per day in 2022. The easy oil was extracted long ago. Despite technological advancements, drillers must continue to search deeper and in more complicated structures. This costs more money and requires more resources.

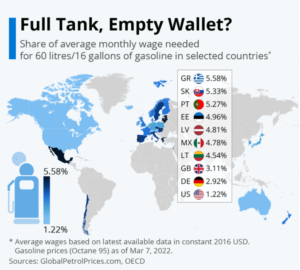

And then Russia decided to stir the pot. In 2021 we imported about 672,000 barrels of oil per day from Russia. This was about 8% of all US imports. Our government (not oil companies) have now banned Russian oil imports. For the record, I fully support an embargo on Russian energy. However, we have the same demand, but less supply. Are we really surprised that prices are rising? This is economics 101.

Ironically, when oil prices actually went negative in the spring of 2020, there were no politicians wanting to bail out the oil companies. Their vehicles and homes just enjoyed the benefit of very cheap fuel.

As such, here we are. Our elected leaders are either just pumping political rhetoric or they have no idea how supply and demand works.

If we believe that Russian oil should be boycotted, then our elected officials need to offer incentives for more domestic oil production, not less. In the short-term with any commodity product, the only way to decrease your equilibrium price is to increase supply relative to demand.

If we want capitalism to work, we cannot expect people to put capital at risk only to have the opportunity to make a profit taken away. Energy stability is vital. However, taxes, such as the one proposed, will encourage less energy development and put more Americans at risk in the process.

Instead of some mis-guided garbage tax, our elected leaders should spend their time developing a long-term cohesive and comprehensive national energy independence program. This would include all types of energy and would be a logical step to ensuring the safety of our nation.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only strategic planning and investment management firm.