What Is Scarier Than COVID?

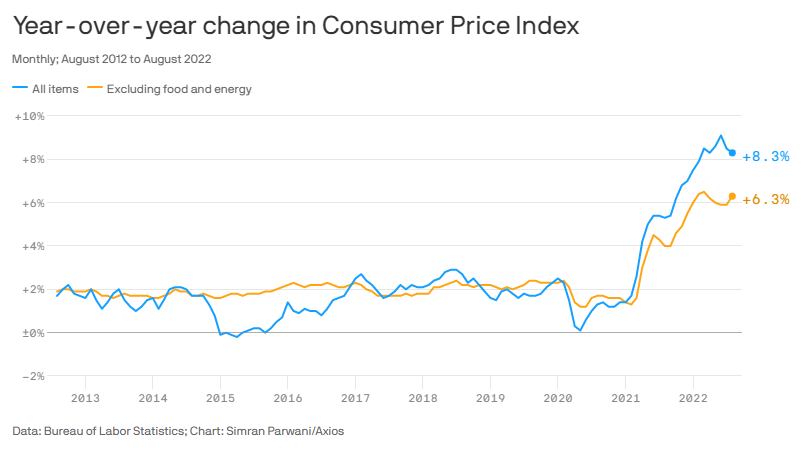

On September 13th, the financial markets plummeted. It was the steepest daily drop since the middle of the COVID crisis. Wow, something really dramatic must have happened to illicit a response as violent as a pandemic. It was the financial grim reaper: persistent inflation.

Sure enough, although energy prices have come down substantially, food prices are up 10% to 15% over the last year and the Consumer Price Index is up 8.3% year-over-year.

To moderate inflation, the Federal Reserve continues to raise interest rates to slow demand. The latest inflation data gives the financial markets a strong belief that interest rates will go up and continue up. And until the Fed stops raising rates, stocks may be stuck.

Maybe I am a simpleton. However, the reaction seems to be a bit extreme. Are we really saying that inflation deserves the same reaction as COVID? I have a hard time making this leap. Maybe a better conclusion would be that Wall Street is creating unnecessary volatility knowing it will increase trading costs and fees. If you follow the money, you’ll find peoples motivations.

Now that you are sufficiently depressed, let me offer a few more data points to contemplate.

What if I told you:

1) U.S. corporate profits for the second quarter broke $2 trillion for the first time ever?

2) U.S. profit margins for the most recent quarter were 15.5%, the highest since 1950?

3) During the average recession, the average decline in corporate earnings is 21%. For the second quarter, companies in the S&P 500 grew earnings 6.3% with 75% beating their earnings expectations.

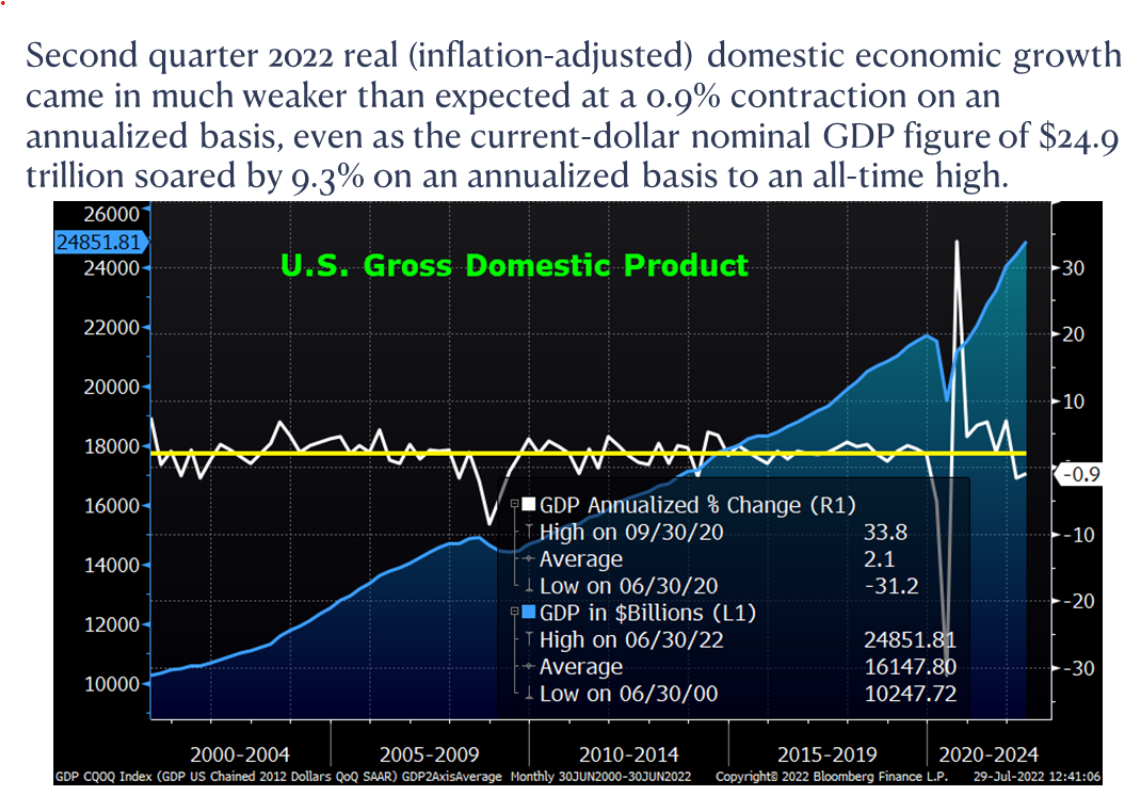

4) It is a true statement that we experienced negative inflation adjusted growth in Gross Domestic Product (GDP) for the first and second quarters. Despite the negative growth rate for GDP, the economy did grow. In fact, it soared to a current-dollar GDP figure of $24.9 trillion—up 9.3% on an annualized basis to an all-time high. Let that sink in for a minute—all-time high.

5) Valuation on the S&P 500 is slightly above its 25-year average Price to Earnings ratio, despite the fact that companies are much more efficient and profitable today than two decades ago.

6) Unemployment remains quite low at 3.7% while wages are increasing at an above average level of 6%. On September 8, 2022, U.S. jobless claims fell for the fourth consecutive week to a 3-month low.

7) Gasoline is down 25% from its highs. Shipping rates from China are down 60% and used car prices had their largest monthly drop since the start of the pandemic.

8) The producer price index (PPI), a gauge of prices received at wholesale levels, declined 0.1%, in line with expectations. On a year-over-year basis, the PPI increased 8.7%, the lowest increase since August 2021.

9) The 10-Year US Treasury has increased from 1.3% a year ago to about 3.5% today. Although that is a large percentage increase, keep things relative. A 10-Year Treasury at 3.5% is nothing compared to the 10% to 15% rates of the late ‘70’s and early ‘80’s.

With these additional data points, does the world seem nearly as scary?

It is very easy to latch on to one data point and conclude that everything in the economy will follow in lock-step order. But it doesn’t happen that way. Yes, inflation is high, and the Fed is challenged trying to reduce it. At the same time, GDP and wages are growing nicely. Corporate profits are efficient and at record levels while valuations remain moderate.

This is far different than the high inflation, low growth stagflation we suffered through during the Carter Administration.

Most likely, if the Fed is in tightening mode, things will be choppy. However, remember that markets do not wait for an “All Clear” signal. They begin to rebound long before the Fed is done.

If you are a long-term investor, you’ll probably look back on this time and shrug your shoulders. If you are attempting to line up all the indicators and make macro-economic decisions, give me a call once you’ve figured it all out. In the meantime, it is so much easier to turn off the talking heads and focus on owning good quality businesses for the long run.