Our National Debt and the Argentinian Solution

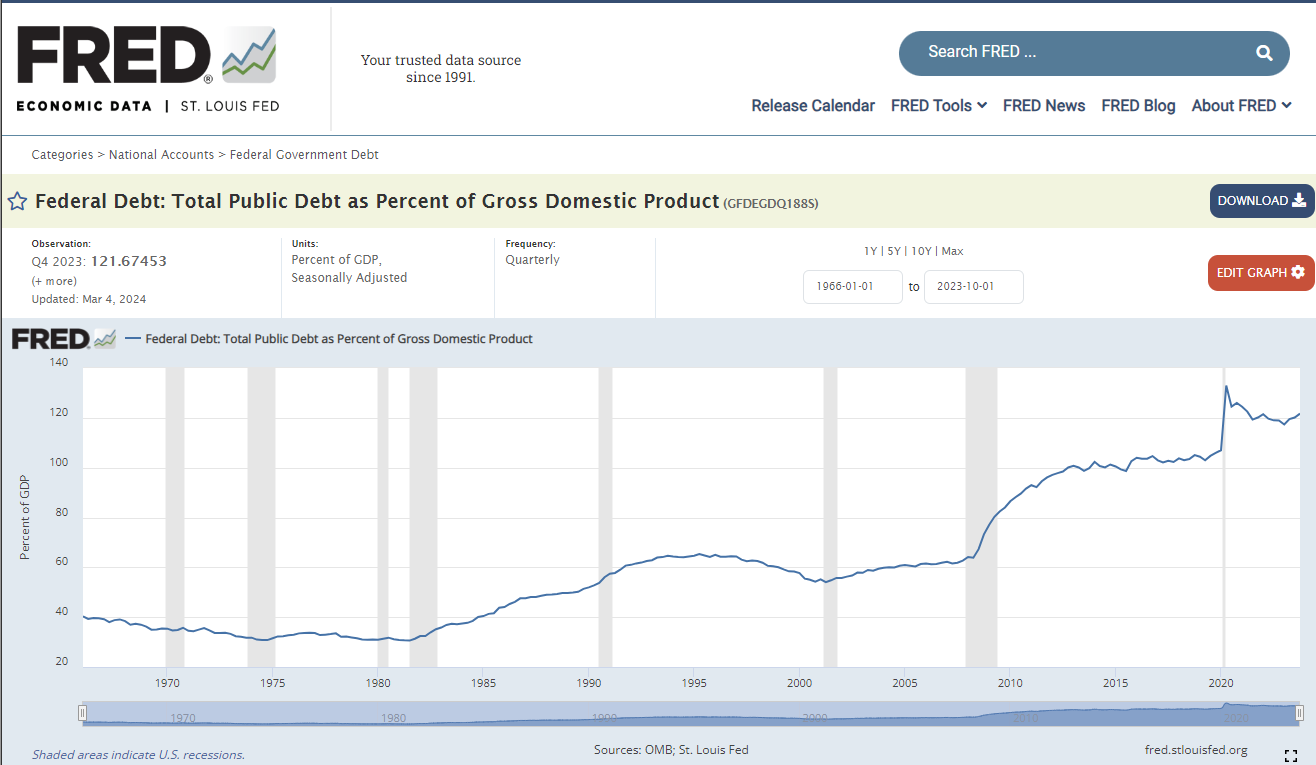

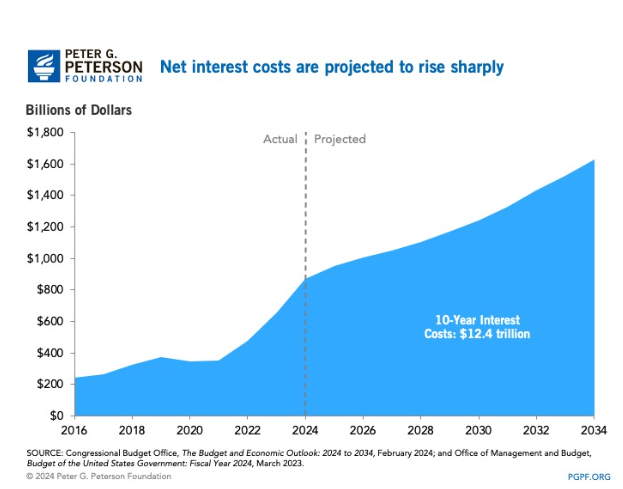

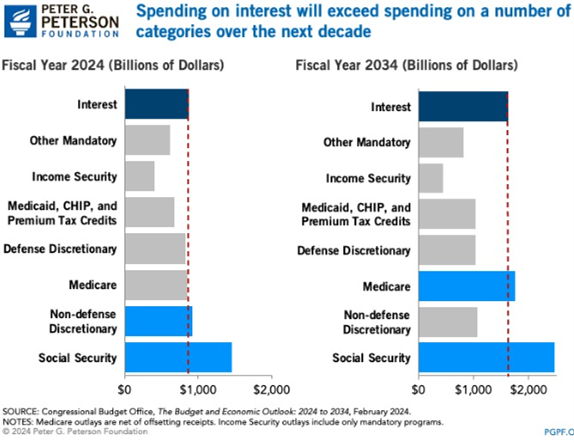

No one argues that the federal debt and associated interest expense is large….and growing.

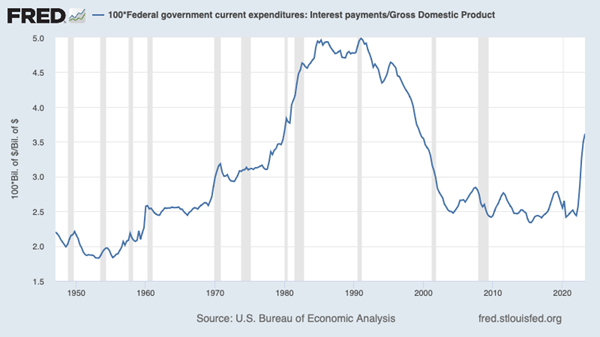

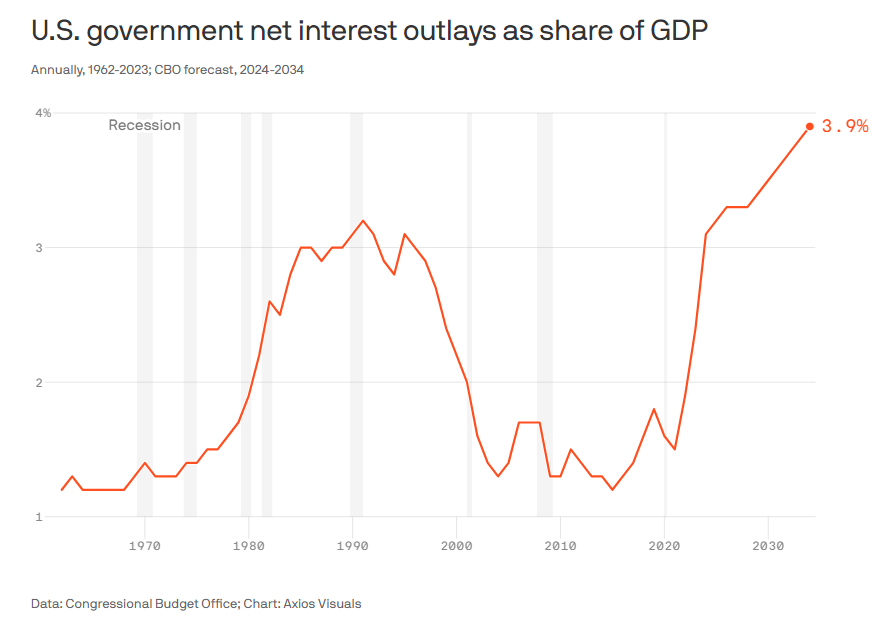

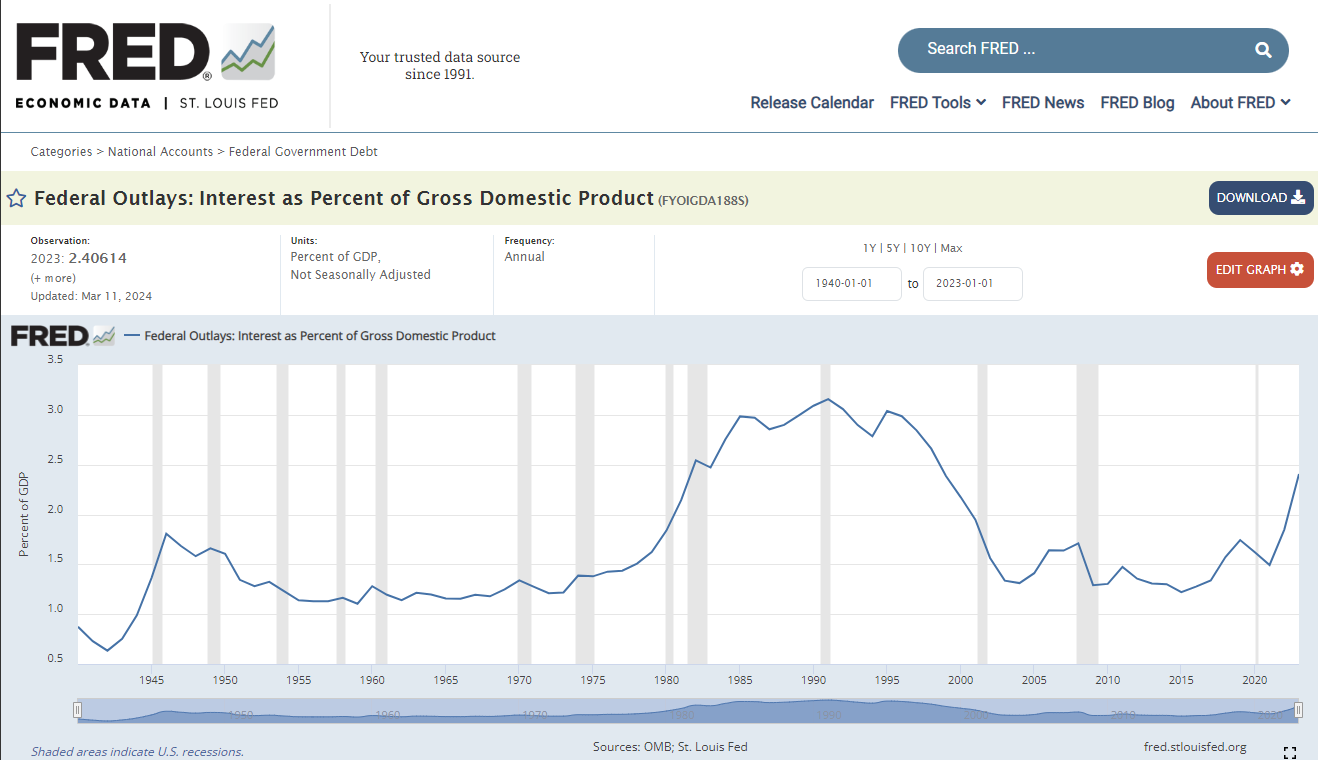

The annual net interest is set to eclipse $1 trillion by 2026. And although debt service costs in the 2010’s were 1.2% of GDP (total sales of the nation), they are projected to be 3.1% this year, rising to 3.9% in 2034. For perspective, the highwater mark for federal net interest cost was 1991 when it was 3.2% of GDP.

How does the average person navigate this dilemma while avoiding unnecessary rabbit holes?

The questions we typically face are:

- Should I sell everything and bury cash in the backyard?

- Should I buy gold or bitcoin?

- Should I buy real estate?

- Should I leave the country?

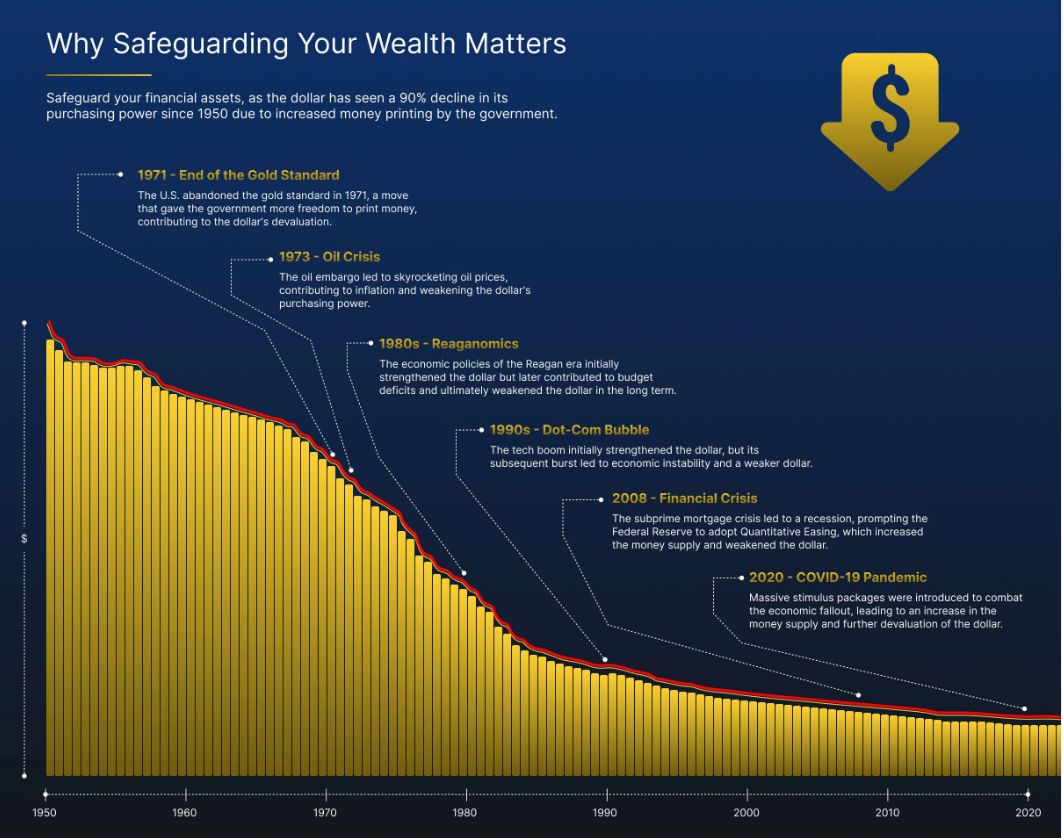

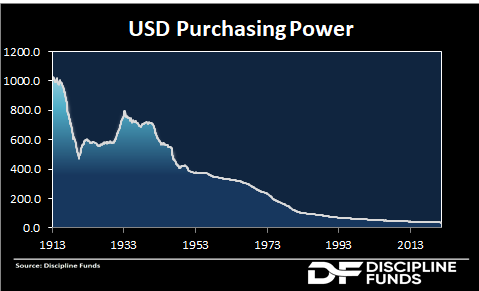

The reality is that since the inception of the Federal Reserve in 1913, our nation has devalued its currency by about 97%. That is a fact and a common tactic used by fear mongers promoting doom and gloom. Despite this, the Dollar remains the world’s most in-demand currency.

The Dollar, like all currencies around the world, loses value over time. This is perplexing to the average person. We can’t run our households in this manner, and it is hard to know what to do.

Gold is very sporadic in its ability to offset inflation or currency devaluation. It performs well in periods of high and concentrated inflation, but then underperforms for decades. Gold does better than cash, but not other assets.

Real estate brings a variety of holding costs in the form of property taxes, insurance, maintenance, and interest costs. After factoring in these expenses, real estate generally appreciates at the rate of inflation. Given this, real estate can offset currency devaluation, but it remains illiquid. Most investors are better off just owning Treasury Bills.

Bitcoin, and other cryptocurrencies, may be a solution. However, it is underdetermined what stands behind them or gives them value.

Given this, it is easier to look for other options.

Other countries have their own problems. Despite challenges facing the US, we have the largest and strongest economy in the world. Inflation adjusted GDP is the highest in the world. It is not even a close race. If you move to another nation, good luck. Send a postcard in ten years and let us know how it works out for you.

So back to the question at hand. How does an individual deal with the national debt and currency devaluation? Surprisingly, the answer may lie in Argentina.

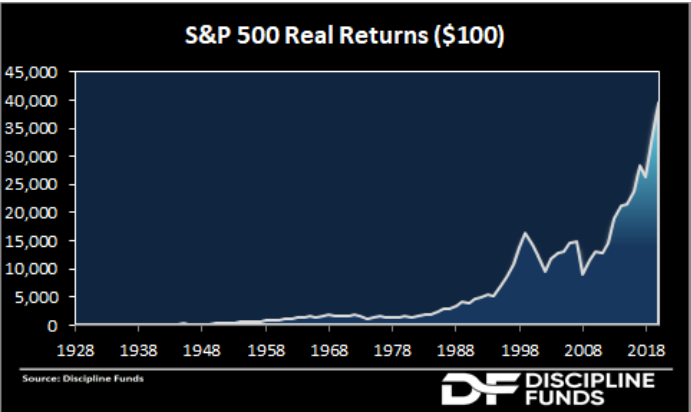

The S&P 500 index, which measures the performance of the 500 largest companies in the US, delivered a very respectable 24% return last year.

However, the Argentine stock market stomped the US returns with a 50% increase. Wow! Does that mean that we should all pile into Argentinian stocks? No. Absolutely not.

Last year, new Argentinian leaders devalued their currency by 50%….in one year! As such, once factoring for currency, their stock market went nowhere. However, productive businesses offered Argentinians the best opportunity to maintain their purchasing power.

They had few legitimate choices.

Argentina is battling triple-digit inflation and teeters on the brink of default. To provide stability, their new president proposed adopting the US Dollar as their currency. Despite predictions from many questionable forecasters, maybe the Dollar is not dead, after all.

However, this highlights the most effective method for the average investor to protect their wealth from devaluation of currency and inflation. This opportunity happens via ownership of productive businesses. A productive business will find efficiency wherever they operate. A productive business can adjust for inflation and maintain profit margins. And truly great businesses will get paid in whatever currency is in demand. This insulates a productive business from less-than-desirable practices of any one government.

And most importantly, owning productive businesses will continue to give individual investors the opportunity to not only maintain, but grow, their purchasing power.

Yes, the US Dollar has devalued by 97%. However, at the same time, US stocks have more than offset this decline in value and delivered true economic growth to patient investors.

Although the benefits of capitalism are often lumpy, it is the tide that lifts all boats. Investing in productive businesses is something I control. For individuals, it offers one of the best liquid opportunities to insulate themselves from questionable governmental policies.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only strategic planning and investment management firm.