Tariffs & The Oprah Tax Cuts

Sometimes, people say the funniest things. Dan is an engineer determined to understand the economic impacts of the Harris and Trump tax and tariff plans. Jokingly, I told him he had too much time on his hands.

However, he concluded we are dealing with the “Oprah Tax Cuts.” Confused, I stopped and asked what that meant. He replied, “ No matter the candidate or audience, you get a tax cut and you get a tax cut and you get a tax cut! It is quite obvious, both sides are simply trying to buy votes with hollow promises.”

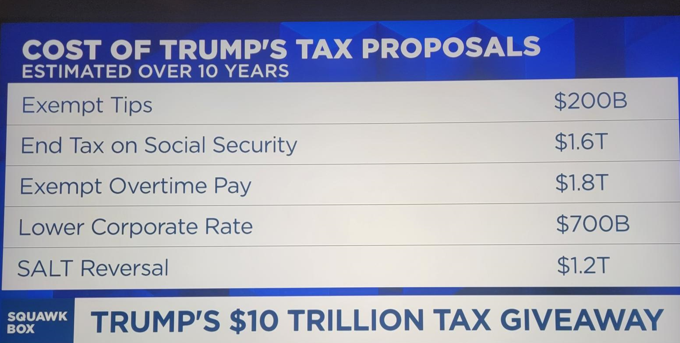

If either gets their way, the Trump and Harris proposals are estimated to increase the deficit between $3.5 trillion to $7.5 trillion over the next decade.

Dan then shifted and wanted help understanding the strategy behind tariffs.

In its simplest form, if the US imposes a tariff, it is a tax that increases the selling cost of a product manufactured outside the US but sold into our country. Unlike some claims, the producer or country of production does not pay the tax. Rather, every American citizen pays the burden associated with tariffs.

This functionally increases the costs for US businesses relying on imported goods. Additionally, tariffs result in higher prices for end consumers which can reduce purchasing power and lead to inflation.

Additionally, we live in a very dynamic and inter-connected world economy. If we assess a tariff against foreign products, we can expect retaliation from other nations. This can disrupt trade flows which ultimately harms businesses and consumers.

As the weight of these tariffs is felt, economic growth slows, and jobs are lost.

Quizzically, Dan asked, “If this is another type of tax burden on Americans, why would our leaders do this?”

Although this seems rather straightforward, it becomes complicated quickly. For instance, countries implement tariffs to protect domestic industries. This is especially true if the cost of production in the US is higher than other places in the world.

President Trump gets much credit or blame for implementing many tariffs during his tenure. It is also worth noting that the Biden Administration kept most of these in force.

In 2018 President Trump imposed a 25% tariff on imported steel and a 10% tariff on imported aluminum. Interestingly, between 2018 and 2020, the president removed these tariffs from certain countries while re-imposing them later.

There are many reasons why the president engaged in this type of decision.

Tariffs can be used to deal with trade imbalances by making imported goods more expensive which in turn, encourages domestic production.

Politicians cite the need for tariffs to neutralize unfair trade practices, such as dumping or governmental subsidies.

More recently tariffs were imposed upon Canadian goods, citing matters of national security. Normally, this type of claim is made around protecting industries considered critical such as steel or aluminum production.

However, in today’s hyper-electric political environment, the truest motivator for tariffs has to do with political considerations. In doing so, politicians attempt to appeal to certain voter groups or respond to pressure from domestic industries.

Dan thanked me for the explanation but remained confused. As such, he simply asked, “What is the impact to the average person?”

It is hard to narrow down the impact to the average family, but tariffs result in higher prices. According to the National Bureau of Economic Research, US tariffs implemented in 2018 – 2019 increased consumer prices by approximately $51 billion. This means the average household paid approximately $460 more due to tariffs.

Tariffs can also lead to job losses in industries that rely on imported goods or those targeted by retaliatory tariffs. A study from the Trade Partnership estimated that US tariffs implemented in 2018 – 2019 resulted in 175,000 job losses.

These factors led to reductions in economic growth via reduced trade and investment. This resulted in reduced wages and job opportunities. As an example, the IMF estimates the US-China trade war reduced global economic output by about 0.2% in 2019.

And as we see on almost a daily basis, tariffs contribute to political instability by increasing tensions between nations.

As Dan and I finished the conversation, we agreed that taxes and tariffs are complicated and everchanging. There are no free lunches. And although tariffs can be used for some good purposes, no one should ever neglect the tangible negatives.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a “fee-only” strategic planning and investment management firm.

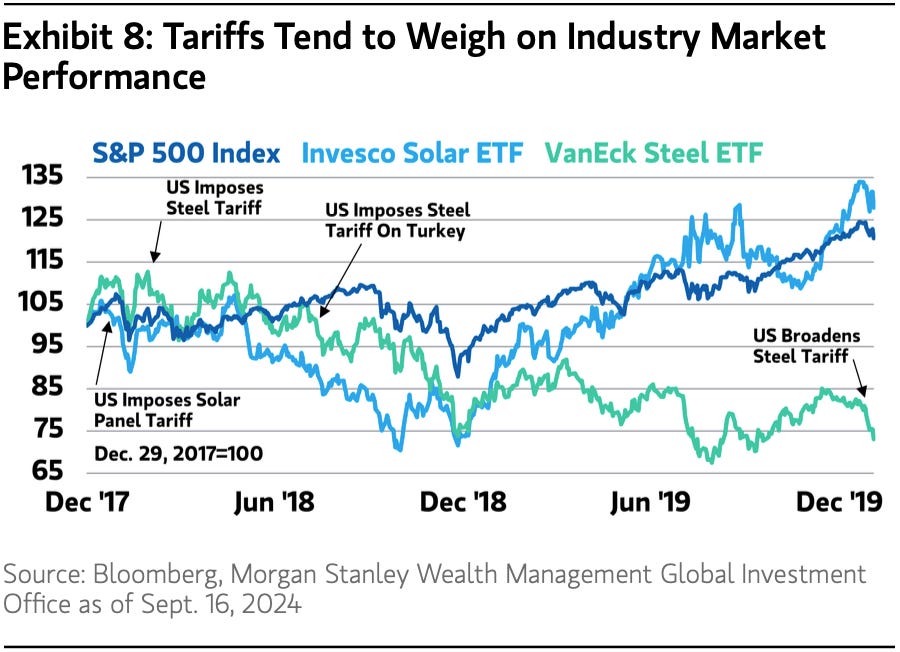

Tariffs are bad for exposed industries 🌏

Generally speaking, tariffs are considered bad news for the industries exposed. From Morgan Stanley Wealth Management: “In January 2018, Trump imposed tariffs on solar panels and washing machines of 30% to 50%. In March 2018, he imposed tariffs of 25% on steel and 10% on aluminum from most countries, which, according to Morgan Stanley & Co. Research, covered an estimated 4.1% percent of US imports. Following these measures, industries impacted by the tariffs underperformed. For example, both the Invesco Solar ETF and the VanEck Steel ETF declined by more than 11% in the first six months following enactment (see Exhibit 8). Tariff related pressures and trade uncertainty at the time caused both solar and steel to underperform the S&P 500 until mid-2019.“