The President & Weapons Of Mass Distraction

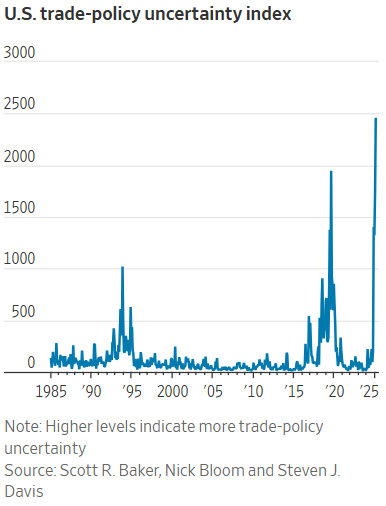

Each new day brings headlines about tariffs to be imposed upon foreign nations and industries.

In response, the financial markets hang on the presidents words, attempting to understand the implications.

The Trump Administration will propose things and not implement them. Things will be implemented and quickly changed. This causes market frustration. Don’t get sucked into the drama of Wall Street or Washington D.C.

Markets are anticipatory. They attempt to see into the future and price assets accordingly. On its best day, this is an imprecise process. When markets lack clarity, they get jittery.

The rapid, and haphazard, nature of potential Trump tariffs gives the markets pause as they digest and forecast into the near-term future.

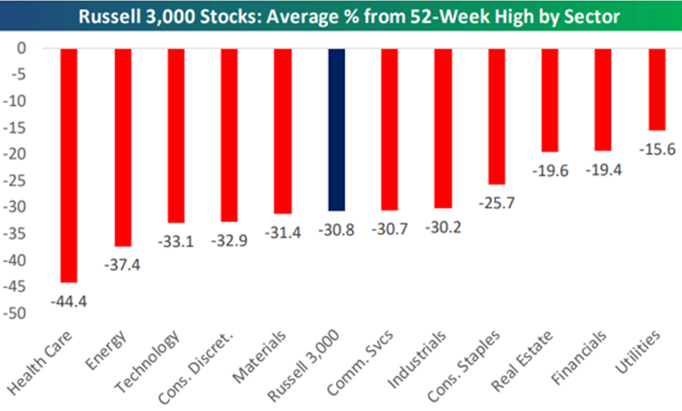

Given this, an elevated stock market reacted swiftly. In less than a month, the S&P 500 fell ten percent, while the average company in the Russell 3000 dropped more than 30%.

Before panicking, understand what we’re dealing with. A traditional tariff is a tax upon society which typically results in inflationary pressures. Estimates from implementing proposed tariffs are that they will cost the average family $2,000 per year and reduce Gross Domestic Product by $110 billion annually.

However, much of this is conjecture as to what, if anything, will happen.

Instead of blindly reacting, smart investors will step back and ask insightful questions to assess portfolios and finances.

What do you know to be true? And if something is true, is it impactful? So much of what is proposed is not only unknowable, we have little idea as to the outcome. President Trump says many things will happen. Few actually have.

Furthermore, Trump-era tariffs may be a different beast. To think about this, you need to get into the mind of President Trump. Virtually everything to him is a negotiation. As such, when he says, “We are going to slap 50% tariffs on autos,” often he doesn’t mean that literally. Rather, he is jockeying for something else, but this is the carrot to induce behavior. When he says, “We’re going to take back the Panama Canal,” he does not mean literal control. Rather, he wants favorable terms for the US and to neutralize China’s access to the canal.

Some misdirection is fairly transparent while others are not. And if you don’t know the outcome with high certainty, then should you make important decisions based upon bad information?

With this as an investor’s landscape, here are meaningful facts to make better decisions.

The stock market offers daily liquidity, not an analytical valuation. The more quickly you demand liquidity, the wider the range of potential outcomes you face. To improve odds of success, hold stock market assets based upon where you want to be in five to ten years.

The stock market has already reacted as if most threatened tariffs have been implemented. For long-term investors, this will be an opportunity.

If you own private, non-traded businesses like HEB or Buc-ees, then market volatility would not bother anyone. We would just focus on business fundamentals and profitability. Just because a business is publicly traded, and markets get goofy, does not mean anything has changed with a business’s ability to generate profits.

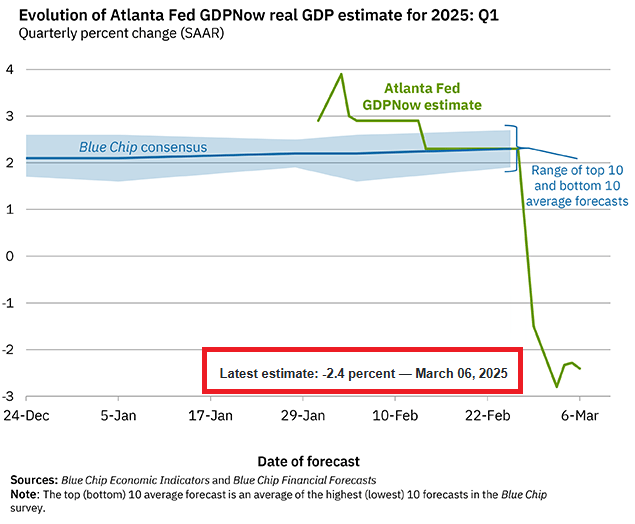

Short-term Gross Domestic Product (GDP) growth is expected to be negative for the next quarter. However, the long-term outlook has not changed in a material manner.

The economy continues to add jobs. Last week we added 151,000 jobs. This was twenty-five percent more than anticipated. The jobs figure represented the 50th consecutive month of US job growth. That’s the second longest streak in history. When people have jobs, the economy does well. Unemployment is currently 4.1%, which is nearly an all-time low over the last 50 years.

Wage growth is currently 4.1%, better than the rate of inflation. This provides the average family more spending money.

The Consumer Price Index, a measure of inflation, is currently a modest 3%.

Regardless of whether tariffs are fair, the Biden Administration kept the tariffs from the first Trump Administration and the economy and markets continued to grow.

Corporate profit margins for the fourth quarter of 2024 were 13.3%. This is up from 10.4% a decade earlier and up from 8% in 2002. Businesses are more efficient, and higher profits justify higher valuations.

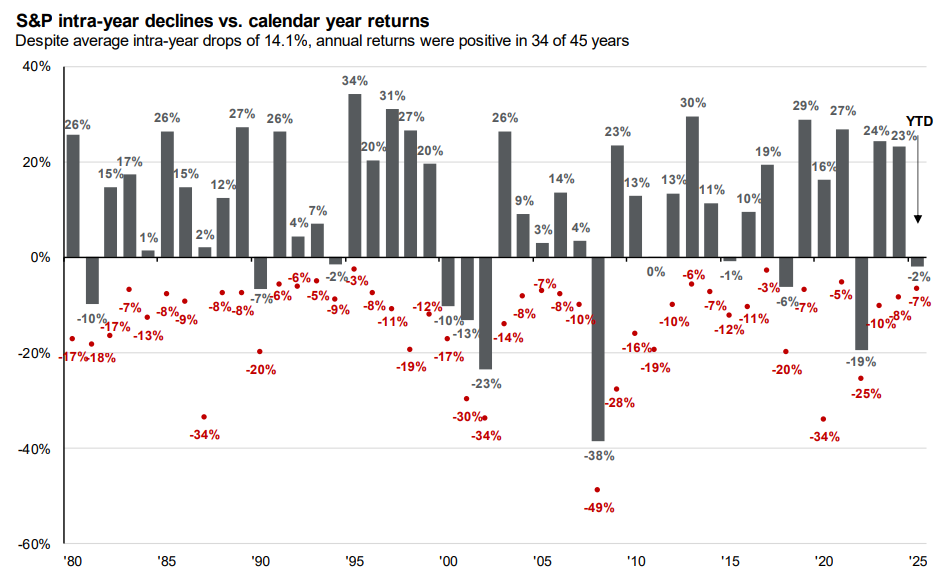

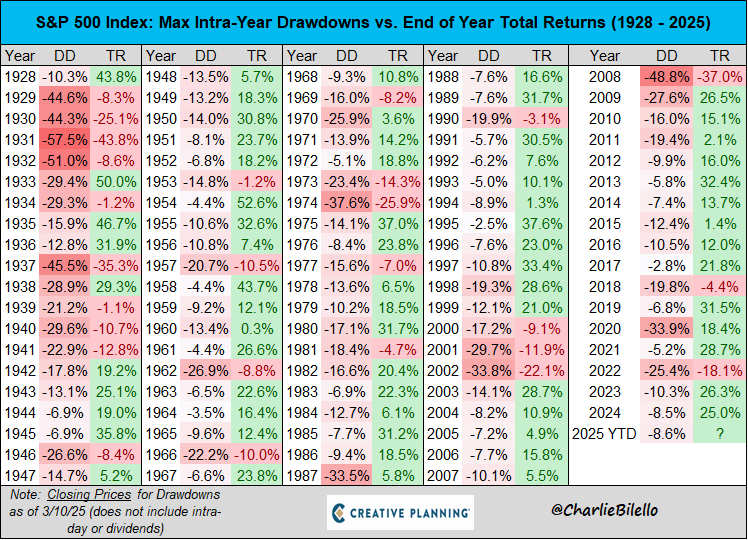

Volatility is nothing new. Since 1980 the market has fallen intra-year by more than 14% on average. Despite this, the market has produced positive returns in 34 of 45 calendar years. Since 1928, the markets have averaged returns of 10% per year.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only investment management and strategic planning firm.

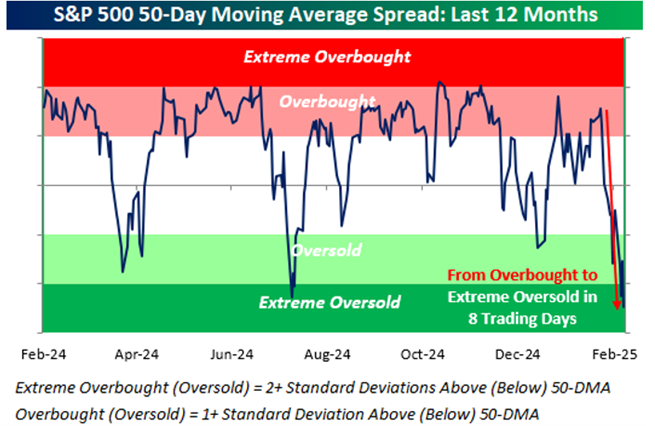

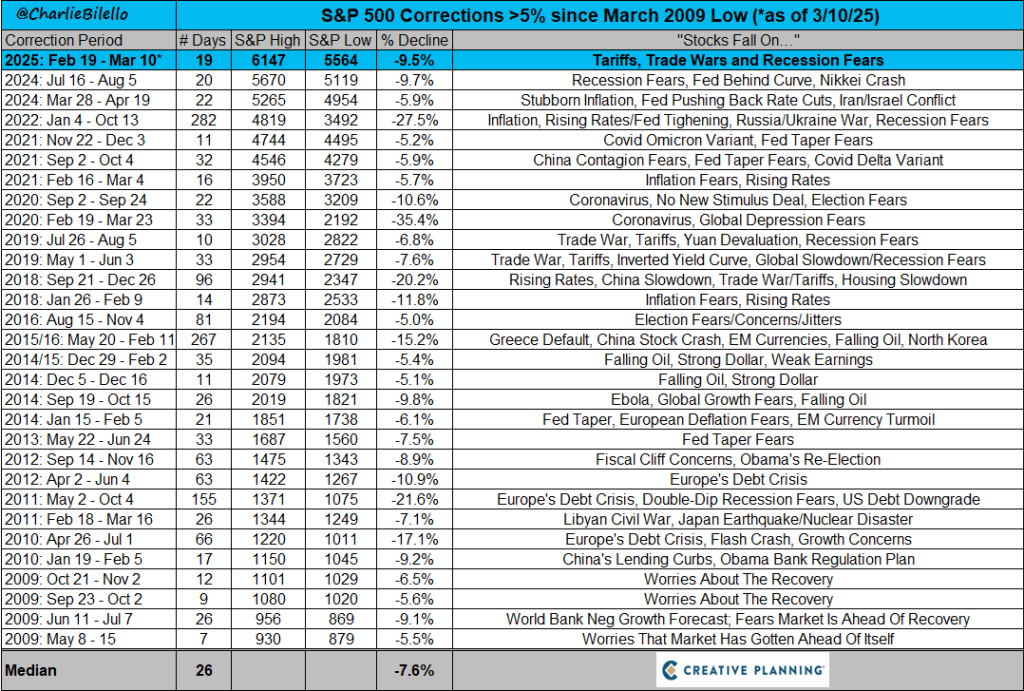

The S&P 500 has now fallen over 9% from its peak on February 19, the biggest pullback since last August. This is the 30th correction >5% off of a high since the March 2009 low. They all seemed like the end of the world at the time.

The S&P 500 has returned an average of 10% per year since 1928 despite an average intra-year drawdown of -16%. The lesson here: there’s no upside without occasional downside, no reward without risk. Downside risk is the price of admission.

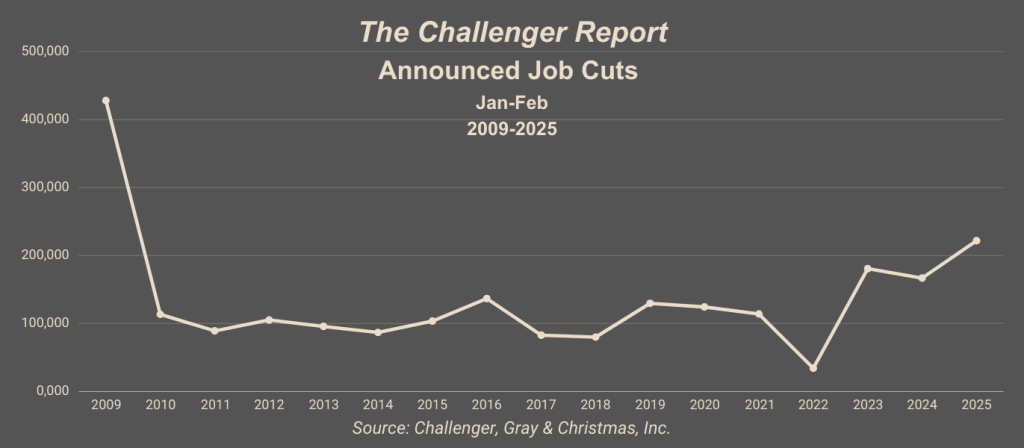

US employers have announced 221,812 job cuts so far this year, the highest year-to-date total since 2009. Of those, 62,530 cuts have come from the Federal Government (DOGE).

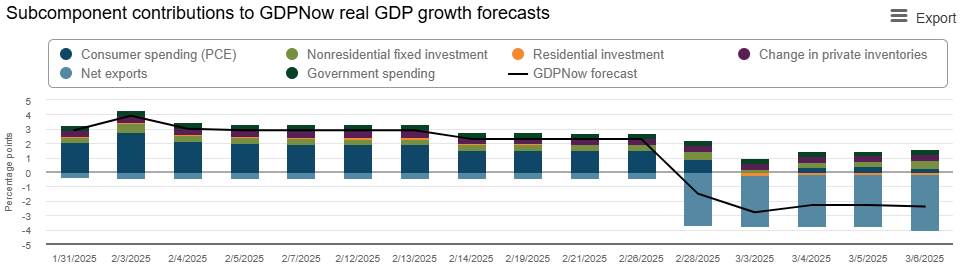

The Atlanta Fed is currently estimating a 2.4% decline in real GDP for the 1st quarter.

What’s driving that estimate? A big decline in net exports on the assumption that US-based companies are pulling forward their imports before potential tariff increases are enacted.