Quarterly Commentary & Five Charts

Covid 19: What Investors Should Learn

The impact of the coronavirus on financial markets will be the type of event that allows the world to mark time. Although unsettling, we will get through this. If you read enough history you know mankind’s ingenuity is at its best when it is under the most pressure. Game on coronavirus!

The coronavirus is what the investment community refers to as a “black swan.” Until a black swan was seen, the world assumed it did not exist. The black swan came out of nowhere and took people by surprise. The same is true for the coronavirus.

As such, build your investment portfolio and structure your household finances to withstand completely unexpected things. This will not be the last black swan event.

Once the world returns to “normal” find an occupation that makes you in demand in good markets and bad. If you can’t do this with one job, consider working two jobs. Get up early, stay late and work a little harder.

This is Aesop’s fable “The Ant and the Grasshopper.” Be the ant who diligently works and saves for winter.

Focus first on emergency cash. If you have enough cash and liquidity, you are better able to withstand exogenous shocks. Make sure you have six to twelve months of living expenses set aside in emergency funds.

Use debt as sparingly as possible. Yes, I realize someone will lend you money to buy an expensive new car or a giant house. It doesn’t mean you must succumb to their offers. There are cheaper options that won’t be a millstone around your neck in a downturn.

Invest in businesses with the “capacity to suffer.” Be an owner of businesses that are built and managed to withstand black swans. These businesses will change over time due to competitive pressures. Exxon is a fraction of its once greatness. Sears is in bankruptcy.

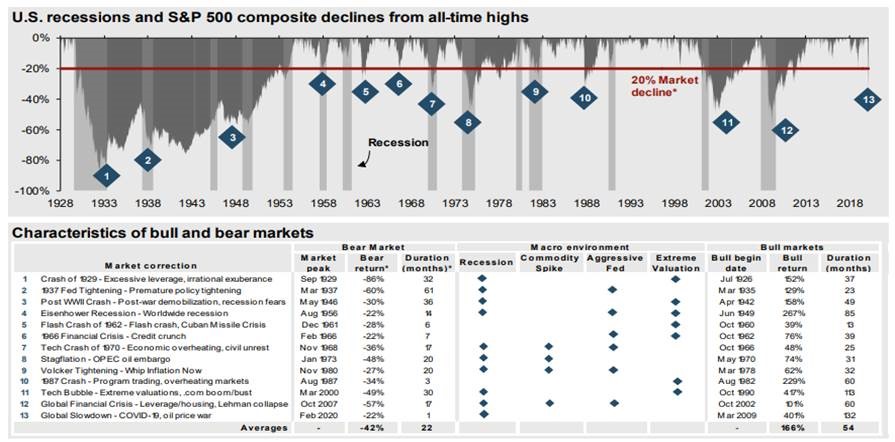

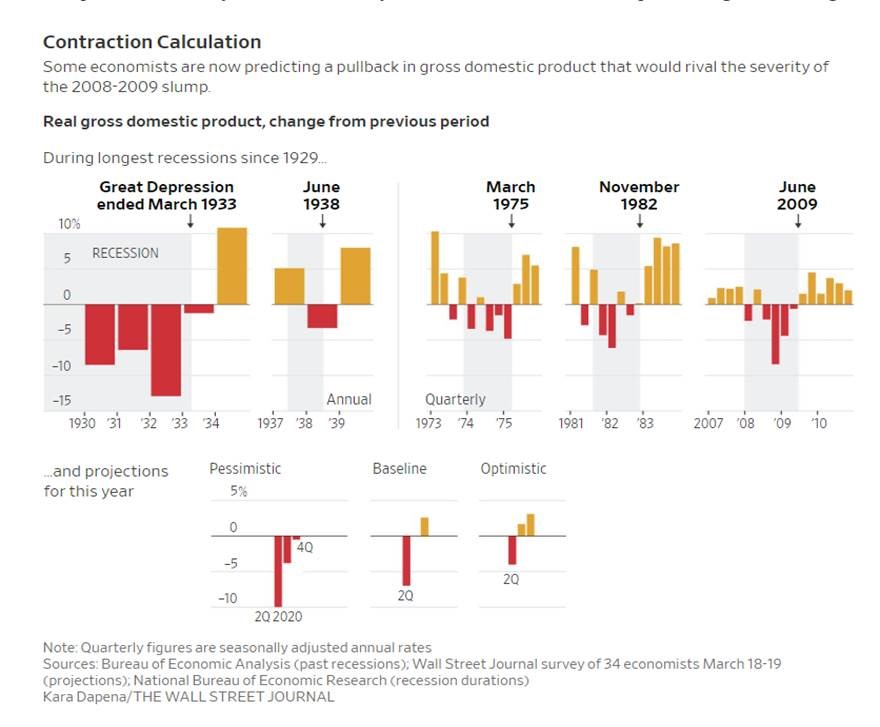

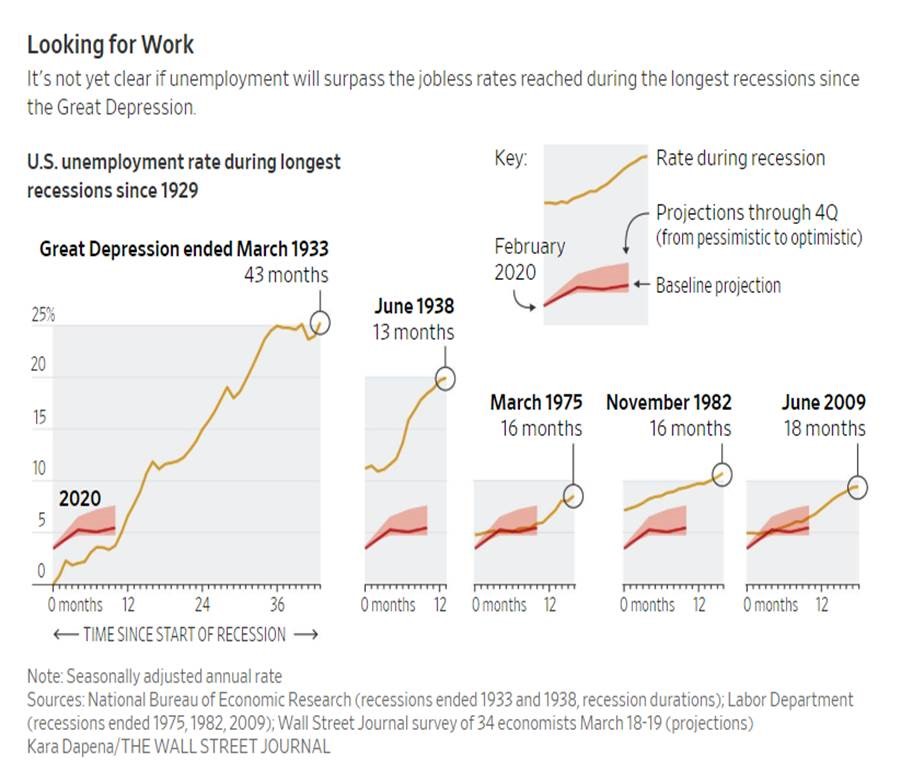

We have suffered through several record setting trading days going back to the Great Depression. Volatility has been enormous.

Call me a conspiracy theorist, but Wall Street loves this. Wall Street firms will book record earnings. They have a perverse incentive to increase volatility as they are the direct beneficiaries.

Making matters worse, many investment funds used significant amounts of leverage in running their portfolios. Using leverage does not make you right or wrong, but it magnifies the amount by which you are right or wrong.

Many hedge funds were operating at ten- or twenty-times leverage. When the market sold off, many firms received “margin” calls in which they were forced to sell out of their portfolios immediately. This made volatility increase geometrically.

Greed is a powerful motivator. It causes people to do very foolish things. It has a ripple effect that can impact your household. Put yourself in a position to be the last one standing.

This is not a time to be emotional. It is a time for logic and discipline. This will allow you to invest in a manner that insulates you from the bad behavior of others.

One middle-aged investor told us he was going to sell out of stocks and move to fixed income. We understand the frustration but would encourage doing the math first.

A 10-Year US Treasury pays 0.66% interest today. If you have $10,000 invested in Treasury notes, you’ll earn $680 over the next decade.

Conversely, if you stay invested in stocks you will most likely earn 7.2%, or more, over the next ten years. This will double your money over this time frame.

Despite frustration with the decline, the statistical odds are that you will make more money by hanging in there.

What if you are beating yourself up saying “I knew the market was going to drop, I should have sold out. I will never see the market return to its all-time high.”

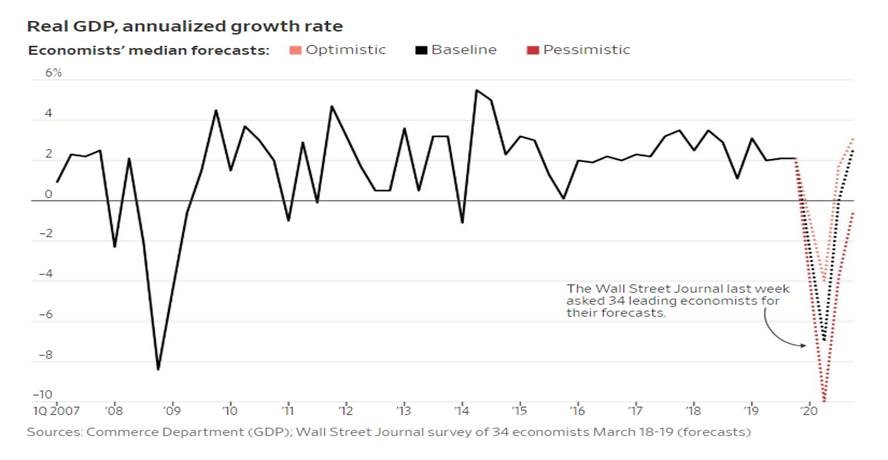

The Dow is at 22,000 today, down 25% from its peak. If the Dow grows at 7.2% per year over the next decade, we should expect the Dow to sit at 44,000. A Dow of 44,000 would be a new record and it would be 50% above the current record.

The stock market is now trading below is 25 year average.

Ten years is a relatively short time frame. Be patient. Let math and logic dictate your decisions.

Be cautious chasing yield. With interest rates so low many are tempted to invest in assets offering “returns” that are five or ten times the yield on the 10 Year Treasury. If an asset is paying cash flow that is five or ten times the baseline treasury return, then know there is a significant amount of risk. The “yield” is being juiced by massive debt or the money you are receiving is really a return of principal.

As we come out the other side of the corona calamity, you can only worry about things that are important and within your control. Despite the bumps, capitalism still works. Lastly, live life on your terms. No one else can walk in your shoes.