Texas Lutheran University Earns International Recognition

The Ghosts of Tschoepe Hall

Fifteen years ago, there were interesting themes resonating throughout education. One was the need for financial literacy. The second recognized the importance of delivering hands-on internships.

With these key ideas, a program was established at Texas Lutheran University to address these challenges.

Initially, Bulldog Investment Company was to teach students how to analyze financial statements and be able to conclude if a business was good or not, and the reasons why.

Although this program naturally attracts business majors, Bulldog was designed to welcome any student on campus regardless of their year or major. This significantly altered the access and composition. Similar programs are limited to upper-class business majors, if not graduate students. Intermixing music, English, math, computer science, biology, physics, and kinesiology majors immediately changed the dynamics for the better.

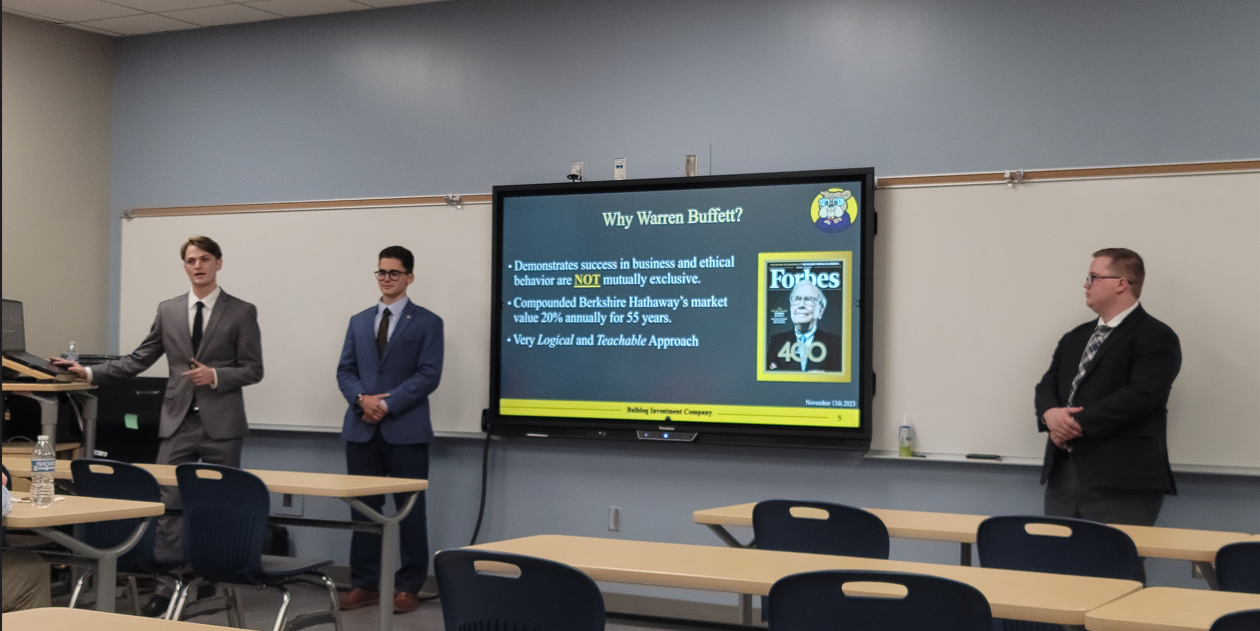

Deciphering financial statement data is a bit dry. To improve engagement, the students were challenged with analyzing companies with the rigor used by Warren Buffett in his legendary career.

To increase the intensity, the program was divided into competing teams. Each team had to identify the competitive advantage of a company and determine why it would remain profitable far longer than the average business. In doing so, students had to develop mastery in analyzing network effects, switching costs, cost advantages and intangible assets.

Obviously, student teams had to deliver fundamental valuation work. In the process, they had to assess why the proposed investment offered a compelling valuation or “margin of safety.”

This research was then presented to professional judges who proceeded to pepper the students with endless questions. These competitions have happened multiple times per semester since 2009, including summers and holidays.

The winning company from each competition was funded into a real portfolio. Currently, the students manage more than $1.6 million. As such, they are keenly aware that good decisions make money while poor decisions cause real pain.

At the end of every semester, the program conducts interviews with the students. What did they like or dislike? If they had all the power in the world, how would they change the program. There has been an open dialogue embracing constant improvement.

The exit interviews were quite revealing. Most of these scholars will never work on Wall Street. However, all will work for an entity that produces financial statements. Being equipped to analyze them and deliver constructive feedback makes the Bulldog Investment Company members highly sought after and valuable.

Incorrectly, it was anticipated that the top take-away from the program would be financial analysis skills. Rather, it turned out to be presentation and public speaking skills as well as the ability to answer and defend questions under pressure.

To prepare for each semester and class period, the students formed their own Leadership Team. Every Sunday, they meet to assess what is working or not. Who needs help and how best to help. In the process, the students became mentors and teachers.

In preparation for meetings and presentations, there were many late nights often lasting past midnight. There was serious discussion and evaluation, along with silliness and laughter, as the Ghosts of Tschoepe Hall ruled the night. In the era of COVID and work-from-home, the students bonded and formed life-long relationships. People are meant to live, laugh, and learn in person.

From inception, student managers had a two-semester commitment. However, they didn’t leave. The average tenure has been more than six semesters with some students completing an amazing ten semester run!

As each year passed, new members realized they stood on the shoulders of giants. The success of the program was not built in a day. Rather, each student added their personal touch. Recognizing this, the students built a database of every member who had ever been in the program along with a profile of where they are now.

This alumni database allows current students to connect with alumni to facilitate guest lectures, mentoring and employment. At this point, the program became a self-fulfilling flywheel of success while teaching financial literacy and providing many internships.

As Bulldog Investment Company finishes year fifteen, their portfolio has outperformed the S&P 500, by 264 percentage points while averaging 15.4% per year.

After presentations at regional and national conferences, the Accreditation Council of Business Schools and Programs, has recognized Bulldog Investment Company and TLU as the 2024 International Best Student Showcase Award winner. The ACBSP provides accreditation for more than 1,200 business programs around the world. Go Dogs!

Dave Sather is the CEO of the Sather Financial Group, a fee-only strategic planning and investment management firm.

(L to R) Dylan Swanson, Joaquin Rodgriguez and William Errett present at the regional ACBSP Conference

The students of Bulldog Investment Company with Three Star General Brad Webb