America After The Election

Thankfully, the election is behind us.

However, over the last several months, we have heard many interesting, emotion filled declarations.

“If Candidate X wins, I am selling everything. I’m buying gold. I’m leaving the country. I am buying guns. I am buying bitcoin.”

Well, the election is over with half the nation upset. However, the world has not ended.

So what is your plan going forward? You still need logical and intelligent decisions regarding your money.

I fully understand your disappointment in our elected leaders. I am too. Our world is messy. This time is no exception.

However, remember, governmental officials do not run businesses. Businesses are run by steely-eyed professionals who know their operations and customers inside and out. They attack the challenge 24/7. They don’t take four years off because a favored candidate didn’t win.

Capitalism has not collapsed. In fact, capitalism delivers gains despite our elected leaders, propelling our nation forward.

Instead of attempting to make critical investment decisions based upon political influence, concentrate on finding rockstar businesses run by capable people. If you can’t have good political leaders, at least you can be selective about who and where you invest your money.

If contemplating leaving the country, where will you go that offers substantial improvement over the US? As you ponder this, consider all the people willing to sacrifice their lives to gain access to the USA. If our nation is such a cesspool, why are there long lines of people hoping to win the immigration lottery?

Along with flawed leaders, we are assured of the devaluation of the US Dollar. Not only does the US devalue its currency with great regularity, so does every other major country with a currency. This is just another version of inflation. As such, invest in assets that offset the negative impacts of currency debasement.

Given all this global controversy, how can Americans remain positive?

According to The Economist, US output per person is triple that of China and even more so than India. In 1990 the US accounted for about 40% of overall GDP from the G7 advanced countries. Today, the US is half.

On a per-person basis, American economic output is nearly 40% higher than western Europe and Canada, and 60% higher than Japan.

Mississippi is our poorest state. And yet, its average wages are higher than the average wage in Britain, Canada and Germany. Let that sink in. Our poorest people earn more than some of the most established nations.

Since the start of the pandemic in 2020, our inflation adjusted growth has been three times the average of other G7 nations.

Contributing to our amazing growth is the fact that outside of a few small countries, the US spends more on research and development, both in dollars and as a percentage of GDP than any other nation. This boosts productivity, output and wages which deliver sizable benefits to our economy.

Despite concerns over the Dollar, we continue to have the world’s reserve currency. Daily, more than half of global trade is denominated in Dollars, even though the US accounts for slightly more than 10% of global trade. The dollar is not going anywhere anytime soon.

The US also dominates both the public and private financial markets. According to Macrotrends, during the 20th century, our stock market outperformed the rest of the world by more than 40% per year on an inflation adjusted basis. Since 2000, our stock and private markets have done even better, producing cumulative returns of more than 500%.

Private markets in the US now raise more in equity than public markets, with private funds tripling to $26 trillion in gross assets over the last decade.

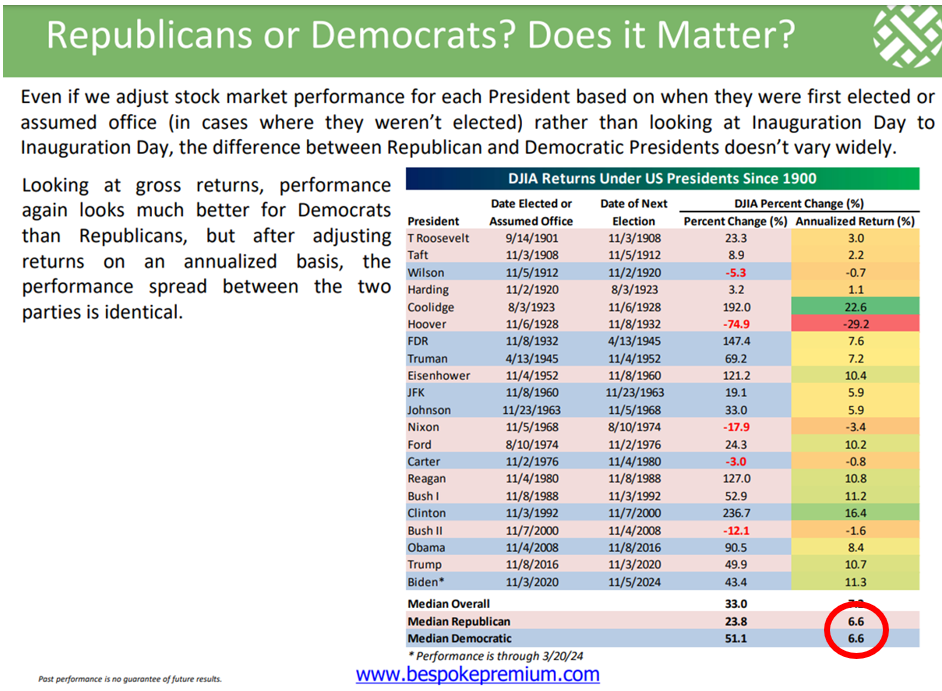

Of course, when analyzing the stock market, someone claims one party is better than another. Based upon research from Bespoke.com, since 1900 the stock market has delivered identical performance whether a Republican or Democrat occupies the White House. Capitalists deliver amazing effort regardless of who holds office.

Considering all this, the election is not the end of the world. Our world is complicated and will remain so. Despite this, we live in a phenomenal country.

As you move forward, only worry about things within your control.

If you made significant portfolio moves prior to the election, move it back to a logical, long-term game plan. Don’t bet against capitalism. America’s success transcends any one person or party.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only and fiduciary strategic planning and investment management firm.