Investing Hindsight & Lessons Learned From Tesla

Investing is a discipline that can make you look downright foolish. Sometimes, no matter how thoroughly you research a given topic, the market can disagree with you for considerable periods of time. And other times, you may just be wrong.

Our past analysis of Tesla is a perfect case. In 2017 and 2018 we wrote negative pieces about the electric car maker. Our analysis highlighted Tesla’s significant $10 billion debt burden while losing $2 billion per year. Tesla had never made a full-year profit.

Tesla struggled to ramp up production of its first mass-market car, the Model 3. Their projections were too optimistic and always past deadlines. Additionally, Moody’s Investor Service downgraded Tesla’s debt rating to B3 (six levels into junk territory) and gave a negative outlook.

At the time we concluded that Tesla was incredibly innovative and truly revolutionary relative to technology and transportation. As such, for a gearhead like myself, it was really hard to root against Tesla and its visionary CEO, Elon Musk.

However, the disciplined investment decision was to pass on Tesla recognizing it was too hard to figure out.

Decisions like this are often considered “binary,” meaning there are two likely outcomes—either you hit the ultimate homerun or you strike out losing all of your money.

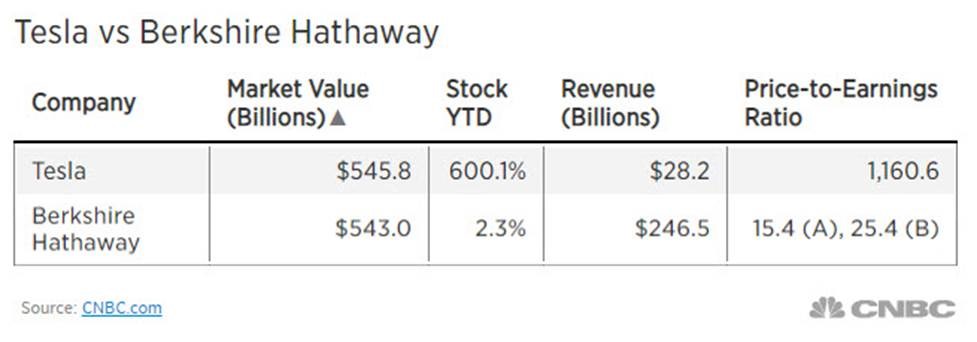

Even with the benefit of hindsight, I stand by the decision to pass on Tesla. However, we missed out on one of the greatest stock stories of the decade. Since we penned that article in 2017, Tesla stock has soared from $60 per share to more than $600. This year, alone, Tesla is up 600%…in less than a year!

Obviously, we missed a big one. But did we make a disciplined decision?

On Twitter last month, Elon Musk offered a glimpse into the challenges of Tesla during that time frame. He revealed that during 2017 – 2019 the production ramp-up of the Model 3 was killing the company. Musk put the remainder of his net worth into the company and acknowledged he did not think the company would survive. At this point he was in so deep that if he didn’t make one last ditch effort, bankruptcy was certain.

During that time, Musk estimated the electric car company was within 30 days of bankruptcy. That is simply too close to the edge of the cliff for us. As such, we believe we made the right decision in 2017 and 2018.

From this, all investors should make certain conclusions about their investment plan.

- Determine if you are investing or gambling. If gambling, there is an acknowledged risk you may lose it all. Investing, on the other hand, requires discipline and a consistency over very long time frames. A long time frame is 10 or more years.

- You don’t have to hit a homerun on every investment. Some of the best investments we have made over the last 25 years have been boring, but consistent. No one looks at the Union Pacific Railroad and thinks it is a sexy investment. And yet, it has tripled over the last few years.

- To be a successful investor you must be willing to look foolish. Just because you do your homework, it does not mean the market immediately agrees with you. The line between fool and phenom is often very hard to identify.

- Fundamental research still matters—even in this elevated market. Take time to understand business models and be able to read and interpret financial statements.

- Successful investing is predicated upon not blowing up. There have been many investment managers who graced the cover of investment publications as “fund manager of the year” only to blow up later. No matter how well you do for a period of time, if you blow your investors up you have accomplished nothing.

- A business can change society. However, it does not make it a good investment. The automobile, the airplane and the internet all revolutionized the way we live. And yet, they have been terrible investments.

- Whether your neighbor is getting rich “quick”, (or claims to be getting rich quick), live life on your terms. The Fear Of Missing Out is one of the most powerful sins that will cause a person to chase illogical investments.

- Ninety-six percent of Warren Buffett’s net worth has been accumulated after age 65. The secret to getting rich is to be disciplined and consistent. Save and invest in good markets and bad. Make logical investment decisions and give them time to work.

Dave Sather is a Certified Financial Planner™ and owner of Sather Financial Group. His column, Money Matters, publishes every other week.