Managing Sacred Investments

The other day I was visiting with an acquaintance, Rusty. The coronavirus left him with lots of idle time on his hands. As such, he called to pick my brain about the upcoming election and a few other financial matters. Eventually, he just wanted to brag about the “killing” he made in Apple stock.

As I listened to Rusty pat himself on the back he said, “I will never sell my Apple stock. Anyone who sells Apple is an absolute fool!”

After quietly listening I interjected that “never” was a very long time. Rusty ignored my point. He reminded me of how well Apple had done; it is unstoppable, and everyone uses an iPhone.

We have had a version of this conversation with many people over the years. The problem is that once a given company has been anointed as the “Chosen One” the force of creative destruction makes its way through corporate America.

Capitalism never sits idle. Capitalism does not throw up its hands and declare that US Steel, Ford, GE, Exxon, Microsoft, Apple or Amazon are now, and forever more, “the winner.” Instead, capitalism steps back and charges at your favorite investment again and again and again. Eventually, the king of the hill is dethroned.

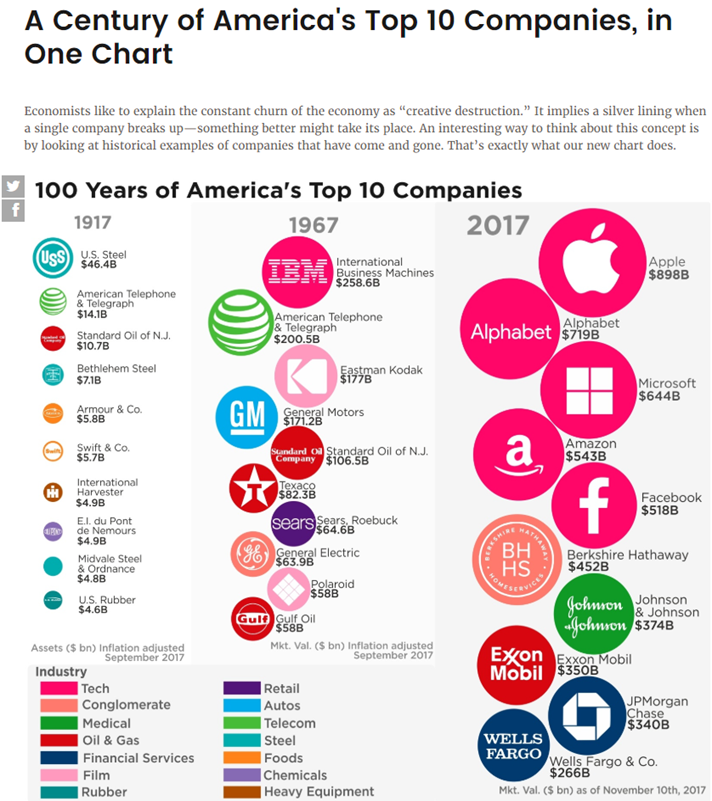

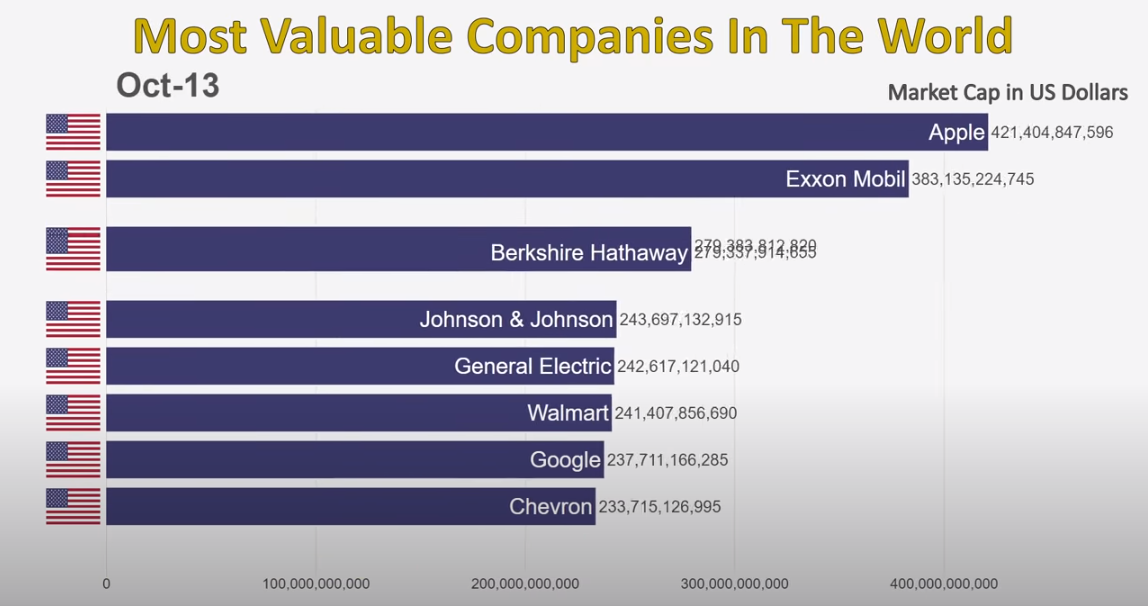

If you look at the history of the largest companies in the US over the last century, this change is painfully obvious. Yesterday’s winner is rarely tomorrow’s winner.

Not only do individual companies change, but so do entire industries. One hundred years ago the top companies came from the steel, oil and chemical industries. Fifty years later we started to see the dominance of technology companies. Top companies were names like IBM, Eastman Kodak, American Telephone & Telegraph and Polaroid.

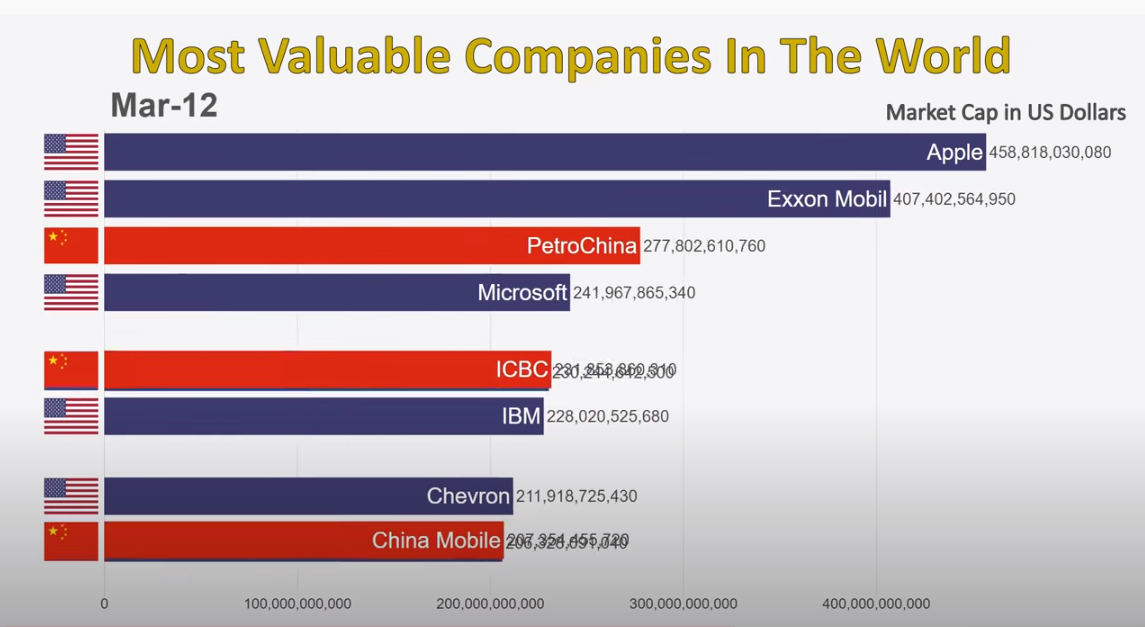

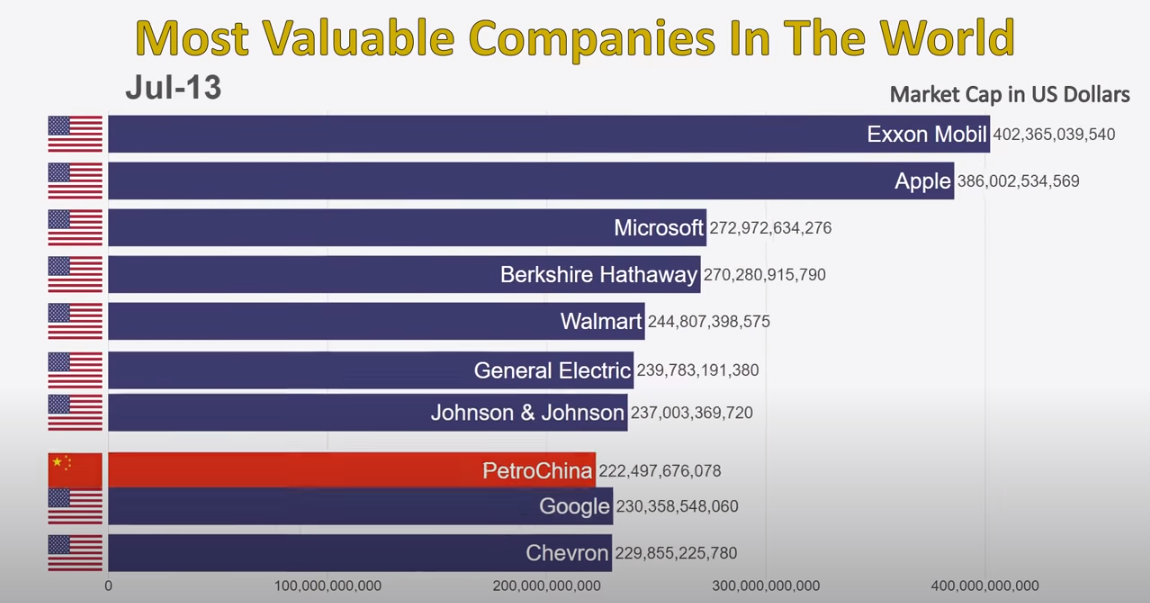

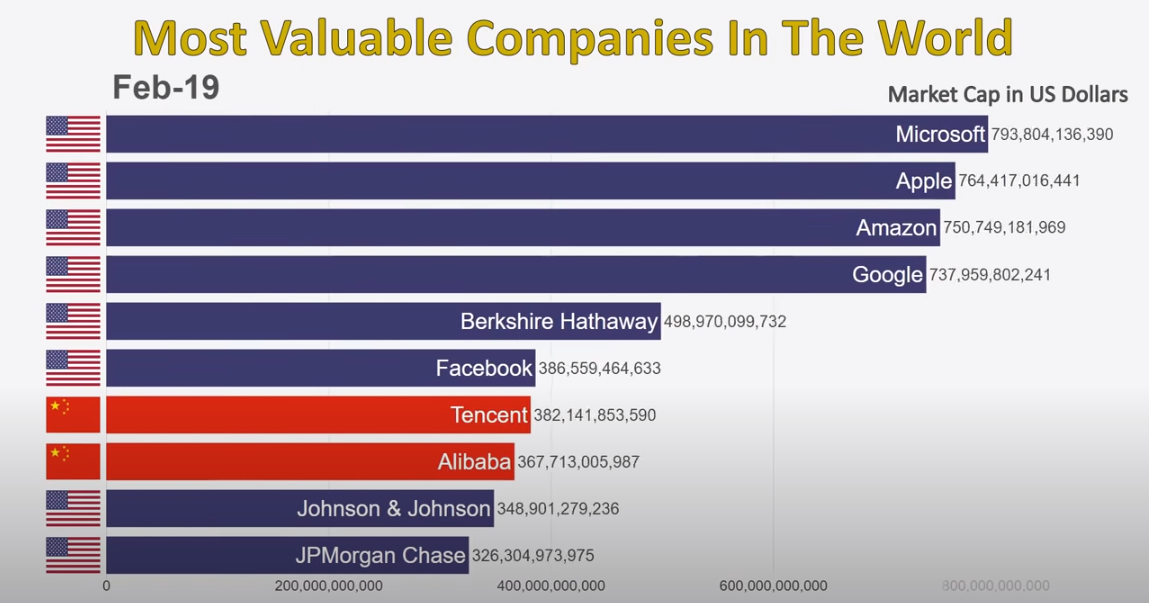

Today, the top companies come from industries that didn’t exist even 25 years ago. Top names are Apple, Google, Microsoft, Amazon and Facebook.

I am happy for the success of Apple and all the other companies that provide growth, innovation, employment and paychecks. However, be under zero illusion that these firms will dominate in ten more years.

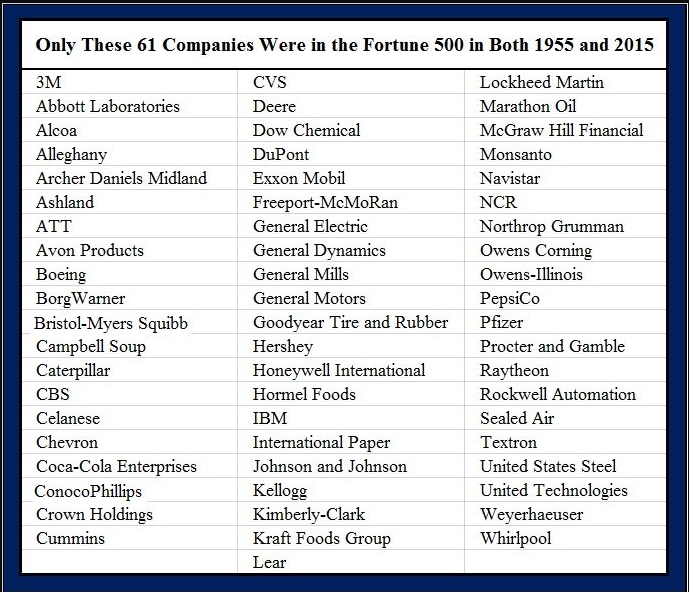

According to research by AEIdeas, of the companies in the S&P 500 in 1955 only 10% remain in the index today. This pace of change appears to be picking up speed. According to Innosight, corporations in the S&P 500 index in 1965 occupied space in the index an average of 33 years. However, it is estimated that by 2026 the average churn rate will be every 14 years.

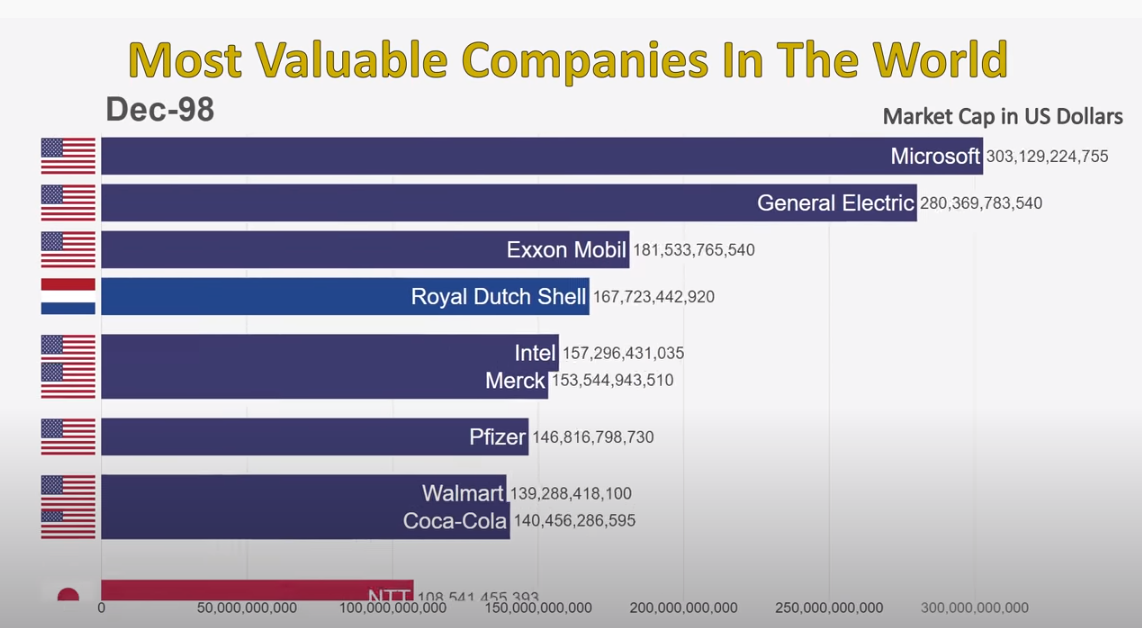

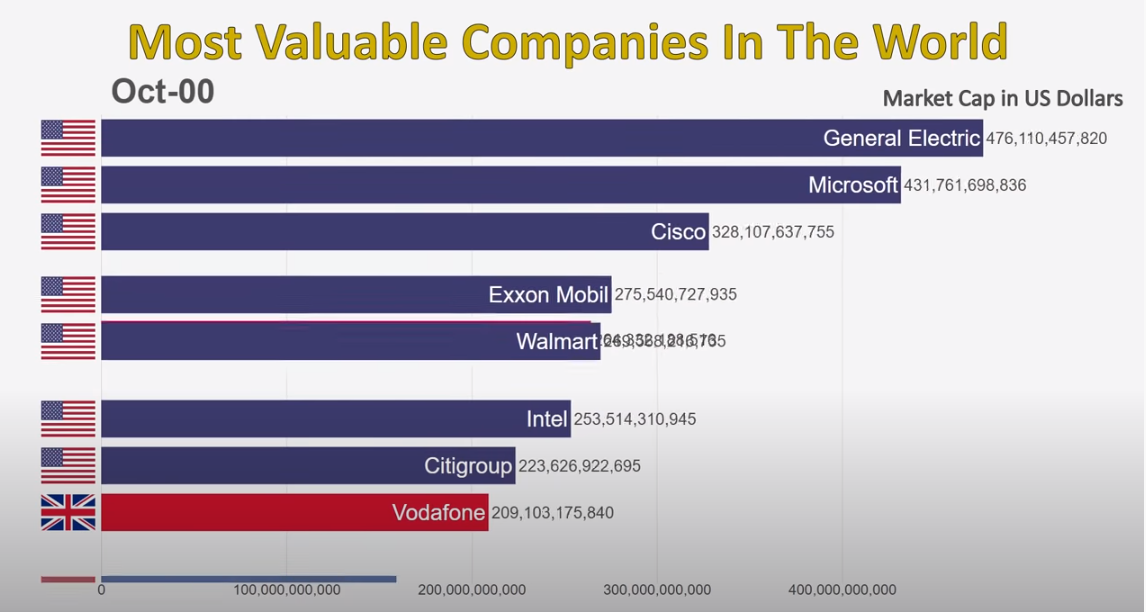

Often, the fall from grace is quite dramatic. In 2000 General Electric was the most valuable company in the world. Due to a variety of bad decisions and circumstances, the value of GE has plummeted by 90%.

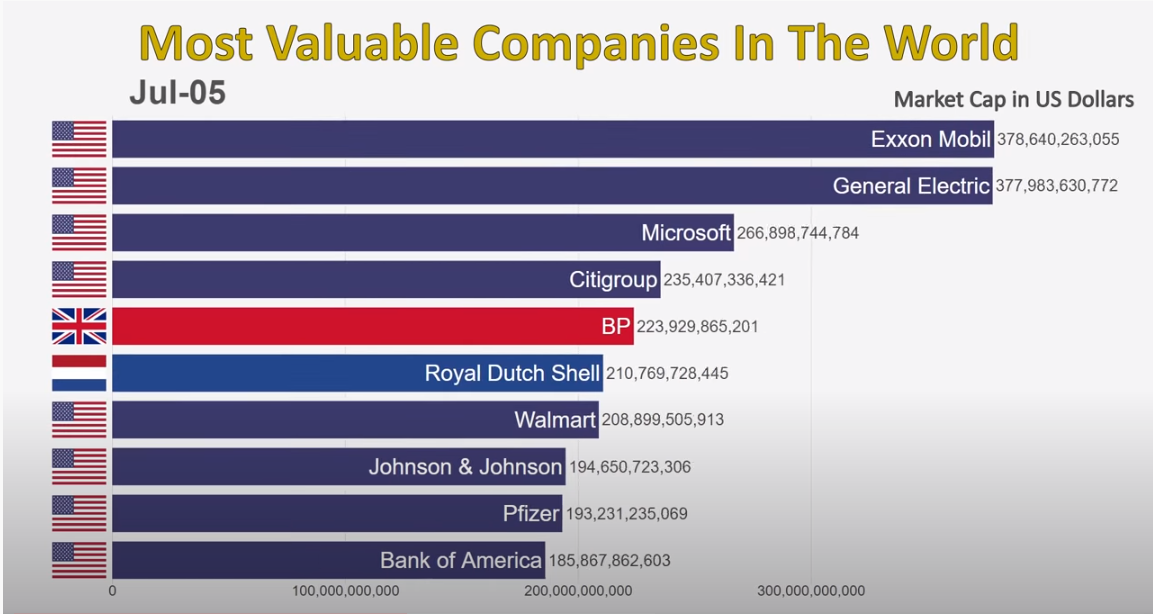

Similarly, Exxon dominated the corporate landscape for much of this century. Its market value peaked in 2007 and has since fallen by an astounding 65%.

Walmart finished 1999 as one of the largest companies in the world. Since then the mighty retailer has hung on to value but twenty years later it is only worth 22% more. The competition has left it in the dust. Despite the increase in value and being at its maximum all-time value, Walmart is barely the 10th largest company today. Amazon, which did not exist until 1994, is now five times the market value of Walmart.

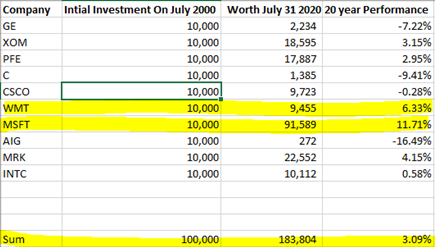

It is easy to pick on a few individual companies. However, this creative destruction applies across a broader spectrum. Assume you made an equal investment into the ten largest companies in July 2000.

Twenty years later, four of the ten produced negative returns. The group of ten produced annualized returns of 3% per year (less than half that of the S&P 500 index itself).

As I discussed this with Rusty, I encouraged him to think about the future prognosis of the businesses he owns. The past is in the past. All the value is in the future.

Given how competitive capitalism is, I encouraged Rusty to think about the following points with any asset he owns:

- Why has a business has been profitable? Will it retain a similar level of profitability going forward?

- What will make it profitable in the future? Is the business highly stable or is it subject to rapid innovation and change?

- What are the keys to making this business model work in the future?

- What are the key triggers you need to monitor that will tell you something has changed?

- How important is the management and how will you evaluate their skill?

- How will you value this asset in the future? What do you consider to be a high, low or fair valuation?

- From an opportunity cost perspective, are there better investment choices available?

Before falling in love with an asset, you need a highly functional understanding of how and why they are profitable and identify the things that will change.

Love your family and your friends, not your stocks. Your stocks do not know that you own them. As such, be as logical and analytical as possible about the future valuation of your assets.

Dave Sather is a Certified Financial Planner and the president of the Sather Financial Group a “fee-only” investment management and strategic planning firm.