Mr. Buffett & Opportunity Cost

This week highlights one of my favorite events of the year. Our investment team heads to Omaha to spend the week with Warren Buffett and a slew of highly accomplished and wise investors at the Berkshire Hathaway annual meeting.

After more than thirty years in the investment business, these learning opportunities remain significant.

Ironically, one of my favorite Buffett-inspired lessons also remains one of my most painful.

When I was twenty-four, I was convinced I was on my way to a life of riches, or so I thought. The only thing rivaling my future wealth was my oversized ego.

While still in graduate school I inherited about $7,000. My parents encouraged me to sock it away. It would make for a great down payment on a house they told me. Instead, my arrogance and immaturity overrode their sensible advice. There was no need to save for a rainy day since I was going to make more money than I could ever need.

With my delusional vision of future riches, I took my cash and bought a loosely disguised racecar. It was loud, fast and obnoxious.

In no time I blew the engine. While having it rebuilt, I decided to begin a frame-off restoration.

Now I had to rent a garage and buy tons of tools. Never mind the fact that I had no time or skills necessary for such a project. Soon, I was broke and sold off what I had at a significant loss.

This was certainly a painful lesson that reinforced a basic lesson I learned from Mr. Buffett early in my life.

Buffett helped me to think through the concept of “opportunity cost”. Simply put, opportunity cost states that if you spend money on something, no matter what, you are effectively arguing that this is the best way to allocate or invest those funds.

I should have considered this before my ill-fated foray into the world of muscle cars.

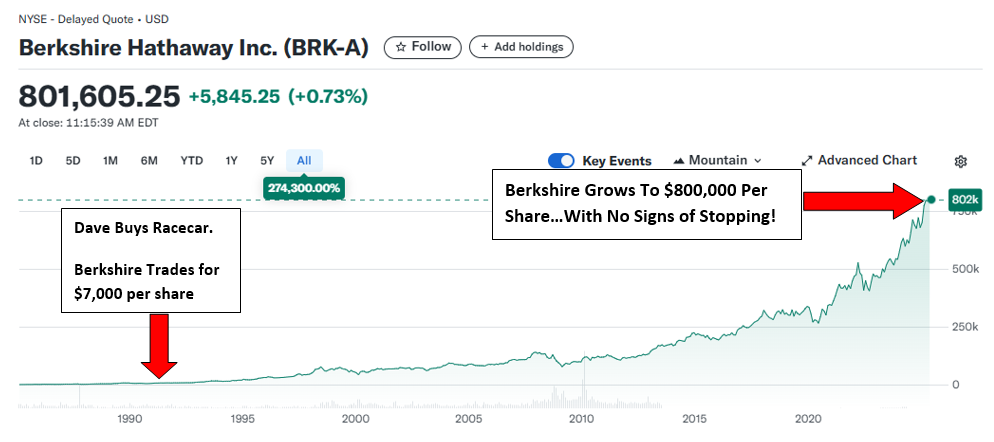

At the same time that I bought the racecar, Warren Buffett’s company, Berkshire Hathaway was trading for about $7,000 per share. If I had logically assessed what to do with my inheritance, I would have invested in Buffett’s company. Unfortunately, I failed to assess the opportunity cost of my automotive decision.

In the end, I lit seven grand on fire. If I had listened to Mr. Buffett, or my parents, I would have invested in Berkshire Hathaway. Today, that one share of Buffett’s company now trades for more than $800,000. For the past twenty years, Berkshire Hathaway’s stock has grown more than 15% per year.

As such, that car I purchased has really cost me $800,000 when factoring in the opportunity cost. That has been a very expensive lesson.

Worse yet, as Berkshire becomes ever more valuable each year, the opportunity cost from my decision only becomes worse.

This story offers many lessons.

I revisit outcomes of this nature at least annually. Although we all love to brag about our homeruns, it is more important to analyze and revisit things that did not work out.

Separate needs versus wants. The car was nothing but a selfish want.

Don’t count your chickens before they are hatched. Making money is hard. Hanging on to money is really hard.

Even if one investment is good, it doesn’t mean there aren’t better choices. The wise investor constantly force-ranks investment opportunities. When allocating money scrutinize the absolute best place for those funds to be invested. This is true whether looking for a new house, paying down credit card debt, investing in your 401(k) plan or wanting to buy a toy. Every decision has a cost.

Patience is an investing superpower. Allow compounded growth to unleash its geometric power.

Leaving investments alone increases tax efficiency. The capital gains tax is not a tax on gains. Rather, it is a tax on the transaction of selling. If you make wise decisions and limit trading, you improve returns while lowering tax obligations.

None of this means you should be a hermit and spend nothing. Rather, think about how and why you spend money. Having a strong understanding of your financial flexibility also improves your ability to deal with things that happen unexpectedly.

Hopefully, our team will return from Omaha with more life lessons. It is amazing how insightful, wise and inspiring the 94-year-old Mr. Buffett remains.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only investment management and strategic planning firm.