Navigating Tariffs, Knowables & Unknowables

As the market reacted to the latest tariff news, Wayne came through the office door with a stern look.

Although he should have been enjoying retirement on the golf course, he spent too much time watching the news.

After minor chit chat, Wayne blurted out, “What is going to happen with the tariffs?”

I told him I didn’t know and I’m not sure anyone knows, including President Trump.

Wayne then asked, “What is the Federal Reserve going to do with rates?”

Again, I replied, “I don’t know.” Although it won’t surprise me if they lower rates, handicapping this is very difficult.

The questions continued as Wayne inquired, “How is China going to respond to the tariffs?”

I told him I didn’t know.

Sarcastically, the retiree said, “I thought you were the guy with all the answers. Why do I pay you if you don’t know anything?”

Wayne sounded like my wife who is convinced I know nothing and if I do know something, it is unimportant.

I explained to Wayne that he does not pay us to know all things, but rather specific things and to have the discipline to know which ones require attention or action.

He squinted his eyes and said, “Like what?”

In the world of investing there are important and unimportant things and things that are known and unknown.

He impatiently rolled his eyes and said, “Thank you Socrates. When did you become a philosopher?”

I assured Wayne that none of the great thinkers would call upon us anytime soon. However, it brought up a good point on how to focus one’s efforts managing money and life, especially during periods of turmoil.

A good investor breaks data into four categories. This is especially important with the information overload we are constantly exposed to.

For instance, I know the sun will set tomorrow. However, in terms of investing, it is unimportant. Most of the “news” the media produces each day is unimportant. In fact, it is a large distraction from things that do matter.

With knowable but unimportant things, it is best not to put much emphasis on them.

Conversely, a tsunami hitting the Gulf Coast would be quite important. However, the timing of such an event is virtually unknowable. With unknowable, but significant, events you recognize they can happen. As such position yourself so unforeseen events don’t wipe you out.

Wayne listened and asked how this might affect him.

I told him the latest on tariffs, China, or the Fed fall in the unknowable category.

And even if I did know the next move in the chess match of tariffs and international trade, I am not sure that translates into making wise investment decisions. Given the number of times tariff proposals have already changed this year, it is extremely hard to not only guess what will be implemented, but the impact.

Obviously, smart investors recognize this possibility exists and position themselves accordingly. In assessing this possibility, anyone exposed to the financial markets should understand a few key fundamentals.

Everyone loves owning stocks when the markets climb. However, it is foolish to run your household only owning stocks. Instead, you need liquid assets to deal with monthly bills and emergencies.

You also need patience and the timeframe to allow stock market assets to perform.

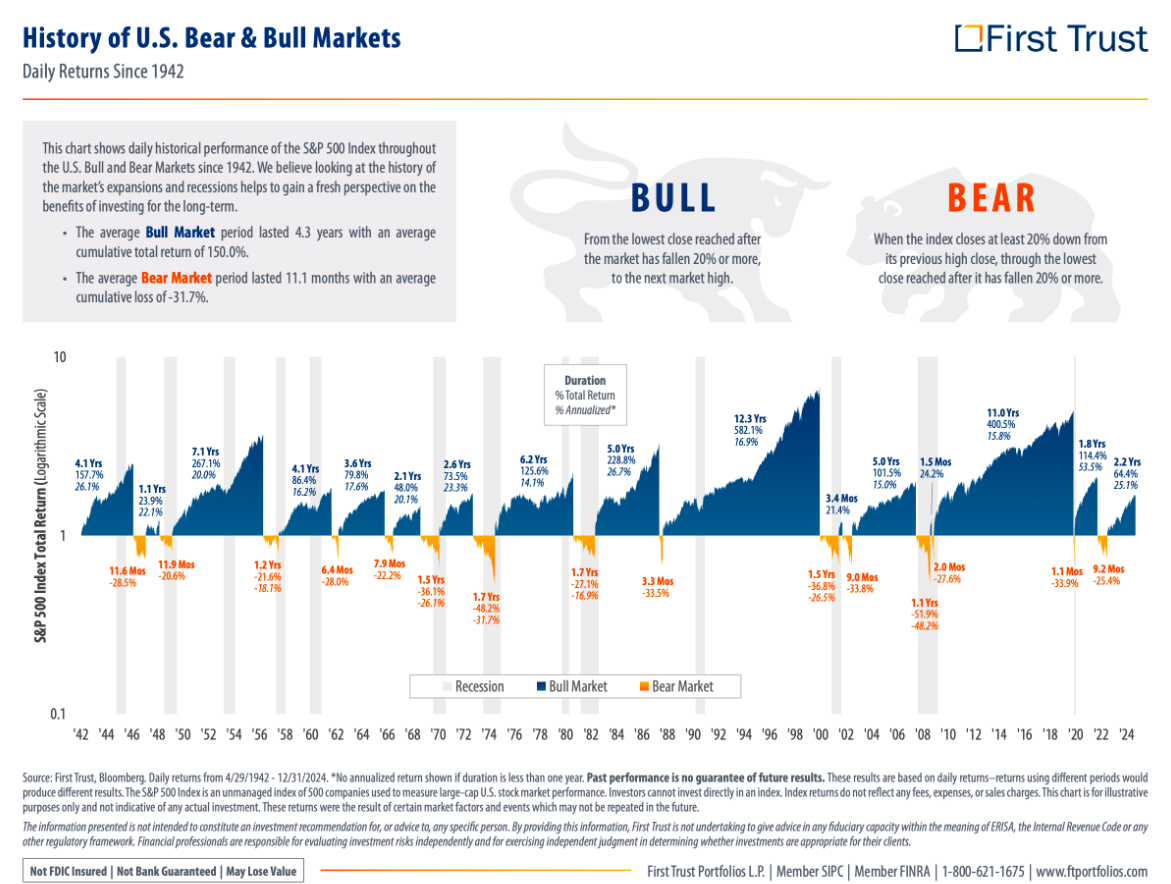

Since 1942 the average bull market lasts 4.3 years producing an average cumulative gain of 150%. Conversely, the average bear market (a 20% drop) lasts 11.1 months with an average cumulative loss of 31.7%. Since 1928, there have been 27 bear markets and 27 bull markets. We have recovered from every bear market.

Given this, limit your debt. Leverage will force you out of solid long-term assets. Hold stocks a minimum of five years, if not ten years. If disciplined about this time frame, you give yourself far more flexibility to ignore short-term flare ups.

After explaining this, Wayne said, “So I pay you to intentionally ignore some things, drill down into things that are important and insulate me from those that are important, but we never know when they’ll happen.”

That summed it up well.

In a world of uncertainty concentrate on things we can control like spending, savings and quality of life. Plan for bumps in the road like political discourse, hurricanes, and even death. Ignore the unimportant. This focus reduces stress and worry while allowing us to make better decisions.

Dave Sather is a Certified Financial Planner™ and the CEO of the Sather Financial Group, a fee-only investment management and strategic planning firm.