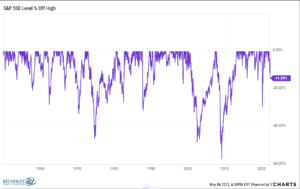

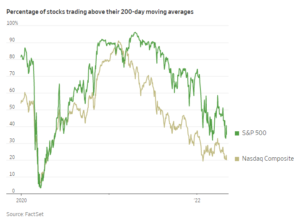

With the broad US stock market down more than 15% this year and the tech heavy Nasdaq down 25%, many investors are shellshocked. They loved it when markets went up but forgot how quickly things can turn.

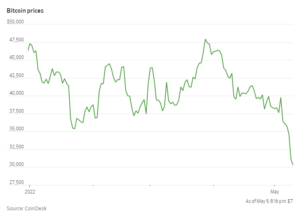

Often, investors balance stock market aggressiveness with fixed income exposure. However, the bond market has declined more than 10% delivering one of its worst performances in 40 years. Adding insult to injury, the real estate investment trust index is down more than 12%, while those seeking shelter with Bitcoin are down over 50% in the last six weeks.

This is a rare situation. We can rationalize that war in Ukraine is upsetting while supply chain disruptions continue to lurk. Additionally, as the Federal Reserve raises interest rates to combat inflation, investors are jittery.

However, there is probably more going on than meets the eye.

Most likely, some major hedge funds failed to “hedge.” Instead, they used massive leverage to juice returns; investment banks were quite happy to lend money as it delivers handsome fees. Many hedge funds plowed borrowed money into a variety of cryptocurrencies and other highflyers. Quickly, this proved to be painful.

The combination of a declining stock market and rising rates has investment banks pulling back lines of credit. As a result, many hedge funds are experiencing forced liquidations. Large players are creating lots of turbulence.

This creates a domino effect rippling through the financial markets. We don’t know how long the waves will crash, but most likely longer and more pronounced than anticipated.

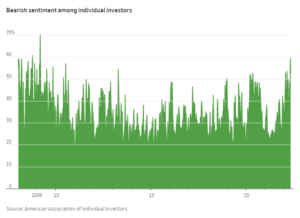

According to the American Association of Individual Investors (AAII), the number of investors believing the stock market will fall over the next six months, as of April, is at its highest level since March 5, 2009. That is serious pessimism!

This leaves the average investor with a dilemma. Can you control the foolishness or overly aggressive nature of others in the investment markets?

Functionally, the answer is “no,” you cannot control others. This is especially true when investment bankers are handing kerosene to children and helping them start a fire. However, you can build your portfolio with solid investments and the structure to withstand the impacts of others.

As you think about how to insulate and protect your portfolio, here are considerations.

Don’t abandon fixed income. Although bond market assets experience interest rate volatility, they revert to par value as they reach maturity. The US bond market has delivered positive returns in 41 of the last 45 years. Being patient with fixed income assets also delivers cash flow while waiting for maturity. As rates increase, so does the cash flow received as you reinvest.

Stocks are businesses possessing value because they earn money. Businesses remain quite profitable. The current price for businesses in the S&P 500 is about 17.5 times annual earnings. This is slightly above ten-year and twenty-five-year average price to earnings ratios. Companies are a little expensive, but certainly not extreme levels. Furthermore, relative to interest rates, the stock market offers better inflation adjusted returns for long-term investors.

I’m not sure what to say about cryptocurrency. Cryptocurrency is a thing, but I have no expertise differentiating one versus another or how to value them. I don’t see how it offers meaningful diversification. It is easier to avoid it.

The average investor is licking their wounds this year and widespread pessimism is palpable. However, pessimism isn’t necessarily bad news. When sentiment gets extremely negative, a rebound is not too far off.

People are working. Over the last year, employers added at least 400,000 jobs each month while unemployment hit 3.6%. When people work, people spend. Nearly 70% of Gross Domestic Product is comprised of consumer spending.

As you contemplate market volatility and what to do with your cash, realize every negative story has an upside if you take the time to look.

As you consider the options in front of you, know the world is not coming to its end. However, to insulate from others your best hedging tool is cash—not crypto or hedge funds. Cash buys groceries, transportation and housing. Cash delivers flexibility and insulates you from the foolishness of others.

Create more cash and cash flow by having a good job. Get up early, stay late and find new ways to earn more. If you earn more than you spend, you provide a tremendous hedge against bad things.

Lastly, despite the hedging benefits of cash, recognize that cash fails to outperform inflation.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only strategic planning and investment management firm.