When I got into the investment business I remember studying time value of money formulas and capital asset pricing models. I thought Wall Street, and investing, was strictly a game of numbers and formulas.

Truth be told, it is a game of logic and discipline, but few people approach it that way. Instead, they allow emotion and irrationality to steer the ship on a financial tilt-a-whirl. As such, emotional intelligence is far more important for investor success.

Thirty years ago, I had no idea what “behavioral finance” was. The industry was in its infancy. I certainly never realized my career would land at the intersection of logic and psychology. I took one psychology class in college. It was a mind-numbing journey of “Intro To Boredom”. However, if I had to do it over, I’d focus significantly more on the psychology and behavioral aspects and less on formulas.

Although behavioral finance may seem unusual, it is something all investors should pay close attention to. Humans are nothing but a hot mess of emotions and irrational behavior. We allow the news media, bloggers, salespeople and politicians to toy with our emotions and lead us down a variety of dangerous paths. Today’s investing landscape exemplifies this dynamic.

Currently, we are told we’re headed for a recession. It has been declared by the finance gods and carved into stone. The Federal Reserve is raising rates to stave off runaway inflation. They don’t care if they ruin the economy in the process.

To really stir the pot, investors worry about Russia’s invasion of Ukraine, supply chain disruptions and the never-ending spread of COVID. There might be a bit of political jockeying too just in case your blood pressure is not high enough.

There you have it. Doom and gloom everywhere. We are on the precipice of guaranteed economic collapse. The Consumer Sentiment figures back up this psychological train-wreck. Data shows consumer sentiment is at its fifth lowest reading over the last fifty years. We are a pessimistic nation.

However, that is what consumers think about where we are today, as opposed to where we are headed. And that is what makes our current moment in time really interesting.

Over the last fifty years there have been eight consumer sentiment peaks. These are moments in which consumers feel great about things. They project that recent history, and great times, will continue as far as the eye can see. In the process, they often pay too much for assets.

Be careful with these euphoric moments. After these sentiment peaks, the average subsequent 12-month returns of the S&P 500 produce a slim 4.1%. This is 60% below the long-term stock market averages.

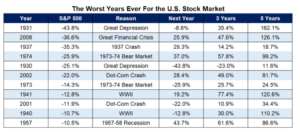

During the same fifty-year period, there have been eight sentiment troughs. During these troughs, consumer sentiment is downright negative. People believe things will never get better. They become discouraged and give up hope.

Guess what? After these sentiment troughs, the average subsequent 12-month S&P 500 returns averages nearly 25%. This is well above average. It is darkest before the dawn and should encourage investors to hang in there.

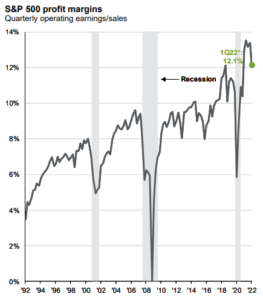

There is more proof that things might improve. The valuation on the S&P 500 is now below its 25-year average. However, the average company is three times as profitable today as it was 30 years ago.

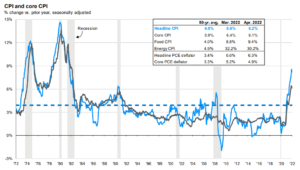

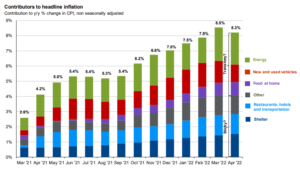

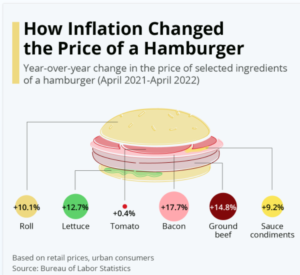

Inflation since March of 2020 has been much higher than the 50-year average. However, it is moderating. The Fed’s preferred inflation measure, the core personal consumption expenditures price index, rose 4.9% from a year ago in April. This was inline with estimates and a deceleration from March. Furthermore, wage pressures rose less than expected.

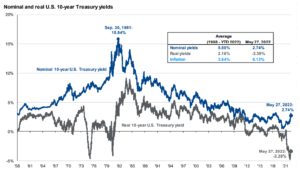

Although the Fed will move to actively curtail inflation, interest rates remain quite attractive. The 10 Year US Treasury remains under 3% and the average household debt service ratio remains well below its 40-year average.

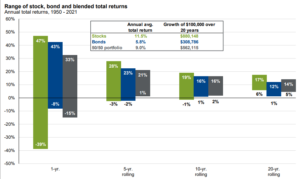

Given all of this, are there problems to work through? Absolutely. However, the number of positive things happening must not be overlooked. If you wait for an “all-clear” signal, the financial markets will already reflect strength and you will miss the rebound. In the process, keep irrational behavior in check. Emphasize a high emotional IQ. Focus on the data and stick to a logical long-term plan. In ten years, you’ll be happy you did.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only strategic planning and investment management firm.