As I stopped at Buc-ee’s in Gonzales to fill up I was amazed. Gas at $2.16 a gallon was three cents cheaper than the day before and the cheapest since 2009.

Consumers nationwide are benefitting from the dramatic 45% drop in oil prices just since June. The unofficial “tax cut” serves up extra spending money at the holidays.

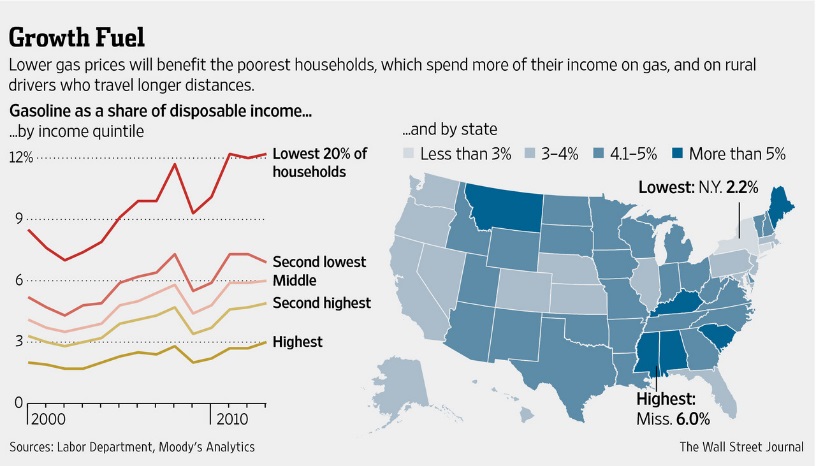

On a percentage basis, gas prices hit lower-income households the most. According to Moody’s Analytics, last year the bottom 20% of earners spent more than 12% of disposable income on gas. In 2000 that same group only spent 8.5% of income on gas.

This should give the average American with an extra $50 to $100 per month. At a time when the median inflation adjusted U.S. income increased only $180 last year, this windfall helps.

Economists anticipate the savings will boost Gross Domestic Product from a lethargic 2% per year to a healthy 3%. This should boost a variety of retail businesses in addition to airlines, oil refineries, transport companies, travel companies and restaurants.

While the drop in oil is welcome news to most, it may not be for most Texans. Our economy is heavily intertwined and affected by the oil patch.

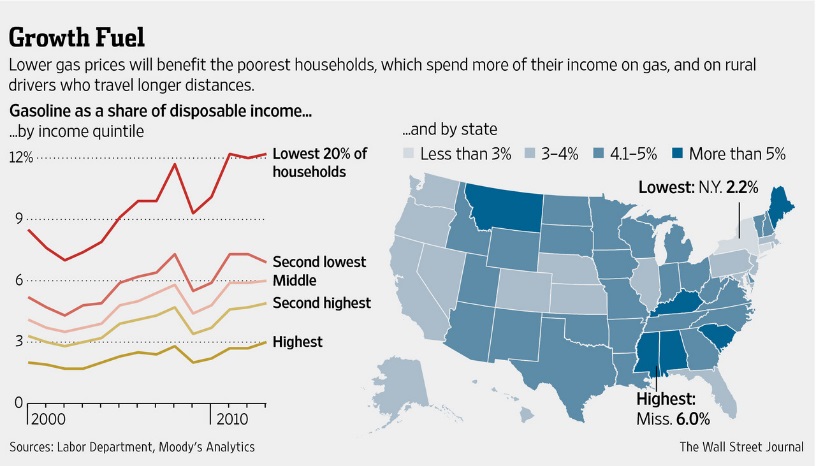

Consider this: the prolific Eagle Ford formation produced its billionth barrel of oil last month according to research firm Wood McKenzie.

Eagle Ford now accounts for 16% of total U.S. oil production and Wood McKenzie predicts exploration and production spending of more than $30 billion in the region in 2015. This is about 22% of the total expected U.S. onshore spending.

Eagle Ford is considered the most profitable U.S. shale field as many analysts peg much of its break-even price as low as $50 per barrel.

On a broader scale, 87% of Texas counties are involved in oil and gas production.

Texas is home to about 47% of all land rigs in the United States and 25% of all rigs working in the world.

There are more than a million Americans working in the oil and gas industry nationwide with 41% based in Texas.

Of all jobs in Texas, 4.4% are in the oil and gas business. However, they account for more than 10% of Texas’ payroll.

Total GDP for Texas in 2013 was $139 billion. More than $16 billion (11.7%) came from the natural resources and mining sector, which includes oil and gas.

According to Dr. Mark Perry Texas’ oil output has doubled in just over two years and is now roughly 30% of the total US output. Perry states this is now the highest daily output since April 1982.

It is easy to see; energy in Texas is a big deal.

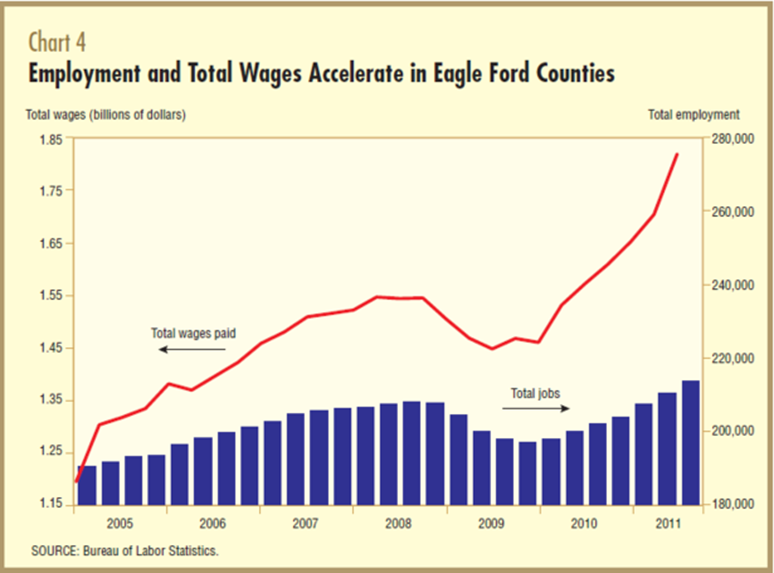

However, the 45% drop in prices will require some hard decisions to be made.

Research from Rystad Energy predicts that global oil and gas projects worth more than $150 billion are likely to be put on hold as a result of plunging oil prices.

ConocoPhillips has already said they will cut capital spending by more than $3 billion next year. BP, Chevron and Shell have announced cutbacks. Precision Drilling, the largest Canadian driller, will cut capital spending by 44%.

This should remind us that commodity prices, especially oil and gas, cycle up and down. In early 1980 oil was $40 per barrel. It did not reach that level again for more than 24 years. It hit $11 per barrel as recently as 1998.

Times are good. However, it is foolish to live your life predicated upon $100 oil for the next 20 years. It is guaranteed to be a bumpy ride.

When times are good, save for that rainy day. Save far more than you ever think you will need. Life is a marathon. We never know when the bottom will fall out of commodity markets, but when they do the person with liquidity will stand to fight another day.

Leverage will kill. With interest rates incredibly low it is quite tempting to borrow big on everything from cars to houses to ranches. Borrowed money does not make you right or wrong—it simply magnifies the amount by which you were right or wrong.

Your banker does not care that you borrowed money assuming oil prices will always stay high.

As with all financial matters, slow and steady wins the race. Prepare for the worst case scenario and if anything else happens, you will be pleasantly surprised.

Dave Sather is a Victoria Certified Financial Planner and owner of Sather Financial Group. His column, Money Matters, publishes every other Wednesday.