The Impact of Downgraded US Credit

Recently, rating service Fitch downgraded the creditworthiness of the US by one notch, from AAA to AA+. Depending upon how you assess the various ratings, this ranks the US 13th for credit worthiness. Fitch said they expect fiscal deterioration over the next three years, due in part to the erosion of governance over the last two decades.

As dire as this sounds, the implications to the nation and average person are difficult to determine.

For more than 20 years the baby boomers have exited the workforce. At the same time there are not enough Gen X,Y or Z coming behind them to fill the gap. This means baby boomers are drawing on Social Security, but the cash flows to replenish the coffers aren’t sufficient.

This funding mismatch should not surprise anyone. However, there are other contributing factors.

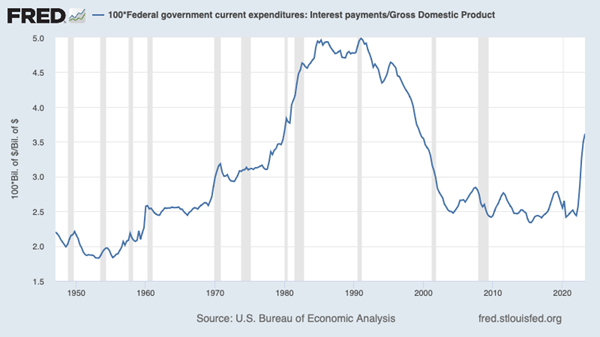

The level of debt we have incurred from 9/11, war in the middle east, the pandemic and expanded entitlement programs left us in a weakened position. Fortunately, when interest rates were low, we were able to run deficit budgets without cratering the economy. However, when rates spike up, servicing the debt becomes more difficult.

As with most complex issues, there are many factors to consider.

The US is the largest, most profitable, country in the world. At $27 trillion, our economy is expected to grow by 3.9% more than inflation. Our economy is 38% larger than second place, China.

Unemployment is at the lowest level since the 1950’s. Seventy percent of GDP (total US sales) comes from consumer spending. When people have jobs, their paychecks circulate through the economy.

In response to the Fitch downgrade Warren Buffett said Berkshire Hathaway bought US Treasury bills last week, this week and will again in future weeks. The “downgrade” does nothing to diminish the strength of our country, currency or ability to pay our debts.

Jamie Dimon, the CEO of JP Morgan, made similar comments.

Why are Buffett and Dimon so confident?

Although not stated overtly, it appears the US is held to a different standard than other countries. Other nations have similar problems, but are smaller or significantly dependent upon the US for support. And yet, they remain AAA rated.

Obviously, personal finance is different than a country’s finances. This is especially true when a government produces their own currency which is the preferred payment for world transactions. It is estimated that 60% of world GDP is denominated in US Dollars. Predictions of the dollar’s demise are greatly exaggerated. As such, you cannot compare personal financial habits to those of the US.

Although the dollar amount of debt is very large, it must be kept in perspective. Our debt can continue to grow as long as GDP outpaces growth in debt. As such, it must always be looked at as a ratio.

The risk of an inflationary spike poses other concerns. The demand from pandemic-related stimulus reminded us of inflationary challenges. If the Federal Reserve raises rates to contend with inflation, it makes the interest component on the national debt more expensive. If the Fed is not successful in curtailing inflation, they may ultimately raise rates even higher, later. The Fed is keenly aware of this and is moving to lower inflation below 3%.

At the same time, we run deficit budgets and print money. Counterintuitively, this means we pay back our debt obligations with devalued dollars. As long as the economy is growing, a nation can pull this trick off.

What does this mean for the average person?

If you live in the US, you pay your bills in dollars. Keep funds needed within 24 hours in cash equivalents. Although banks remain less competitive, brokerages consistently pay 5% or more on money market assets. You can also roll CD’s or US Treasury bills to generate cash flow on liquid assets.

Things like gold, bitcoin or other “alternative” assets are completely speculative. They are never a substitute for cash.

To maintain purchasing power, the best option for long term investors remains ownership of productive and profitable businesses.

Lastly, should the U.S. use more fiscally sound disciplines? Yes. Do we have our challenges? Obviously. However, despite this less-than-optimal behavior there is no other country or economy I’d rather be in.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fee-only strategic planning and investment management firm.