The New Gold Rush

Whenever I repeatedly receive the same question from clients it makes us take a step back and ask why.

In this particular case, the question has been, “Should we own gold?” I’ve probably had a variation of that question ten times in the last month.

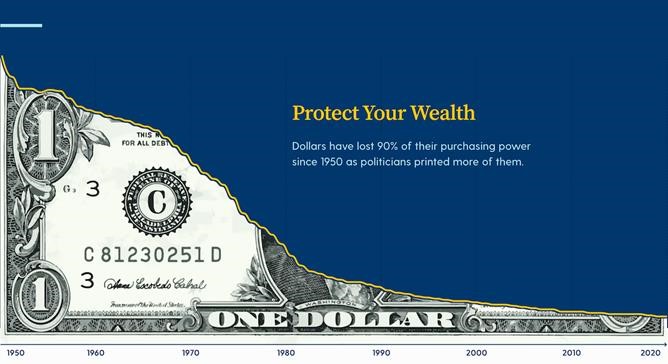

As a less-than-scientific observation, I see many ads promoting gold on the news channels. They are generally accompanied by some ominous warning that the dollar is going down in value and you better buy gold before the end of the day. They also tout the performance of gold over very specific and unique dates.

The ads have worked. They got people to ask about it. However, if you follow the money you identify people’s motivations. The people extolling the virtues of gold are selling precious metals and want to make a commission off of you.

There is also the “fear of missing out” as gold has been a strong performer lately. Over the last year an ounce of gold has increased 29%. During the same time frame, the stock market is up 13% while the bond market has posted an 8% gain.

Additionally, Warren Buffett’s company, Berkshire Hathaway, recently added a position in the miner Barrick Gold. Buffett himself has repeatedly expressed his disdain for the shiny metal. Has he had a change of heart?

In the case of Berkshire, keep this investment in perspective. It amounted to 0.23% of Berkshires portfolio. It is a rounding error for them. Furthermore, Buffett has a couple of lieutenants that manage portfolios for Berkshire. Most likely, the Barrick investment is a trade made by someone other than Buffett.

Valuing gold and determining where it fits in a portfolio makes me scratch my head. I struggle with it.

The process of evaluating an on-going business is fairly straight-forward. You attempt to estimate the future stream of cash flows a business will generate. Then you determine what you are willing to pay in today’s dollars for that stream of cash. Some businesses have tremendous history and cash flow consistency. Others require a lot more guess work.

In attempting to value the shiny metal, gold does not pay a dividend or interest. Unlike other metals, gold does not have a meaningful industrial use. Although you can make jewelry out of gold, I wouldn’t consider it a necessity. You can’t take gold to HEB to buy groceries or gas.

Making matters worse, the owner of gold either directly or indirectly has to pay to secure it, store it, and verify its purity. And if we truly have a nuclear type of event I am not convinced that gold is going to do you much good—other than to serve as a paperweight.

For all of gold’s shortcomings, it is often viewed as a universal representation of value. Unlike paper currency, a government cannot simply print more gold.

As governments devalue their currency, gold therefore continues to be a popular strategy to hedge this currency problem.

Over the last 20 years the Federal Reserve and Treasury have been called to soften the blow of economic hardship. One can see how the government has either issued debt or manipulated interest rates lower. This tends to weaken the value of the dollar.

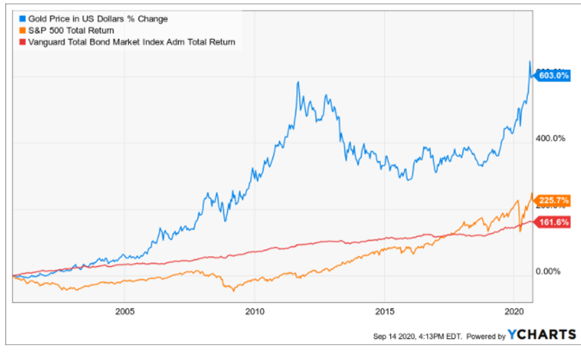

The “Tech Wreck” of 2000 was followed by the 9/11 terrorist attacks. These events caused the government to act in a way that weakened the dollar and made borrowing more attractive via low interest rates. During the twelve years between 2000 and 2012 gold significantly outperformed cash, bonds and stocks.

Similarly, the Fed and Treasury intervened in the aftermath of the 2008 housing and banking crisis. Again, debt increased and interest rates went down. Between 2009 and 2011 gold significantly outperformed cash, bonds and stocks.

And this year, thankfully, the Fed and Treasury sprang into action to increase debt, lower interest rates and devalue the dollar. Gold has performed strongly.

Before firing off a trade to buy some gold, you might want to analyze broader time frames.

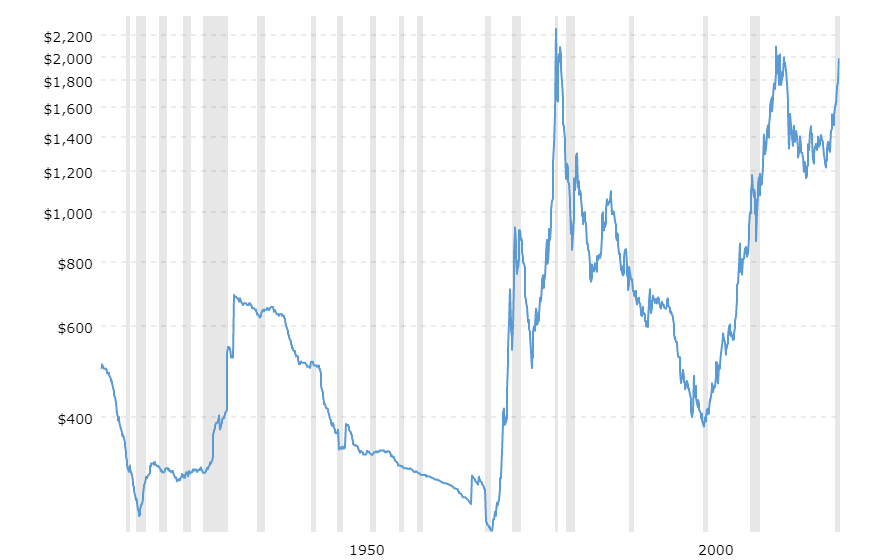

After gold’s big run between 2000 and 2012 it subsequently fell 40% over the next three years. Since 2012 to today, gold has traded sideways.

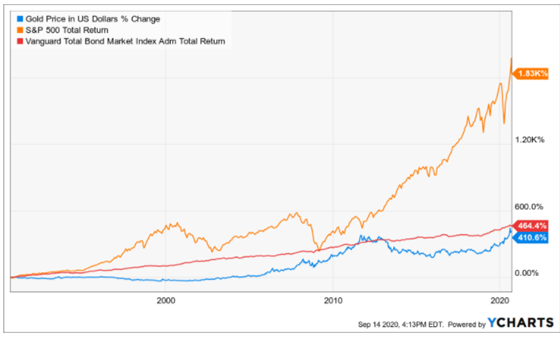

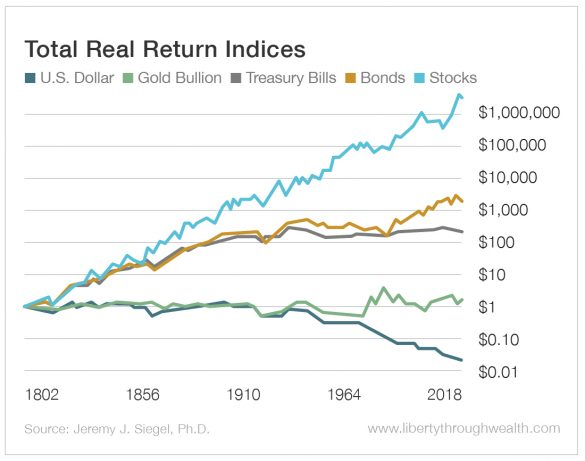

Over the last 30 years gold has trailed the bond market and has gotten crushed by the stock market.

Despite gold’s run this year, on an inflation adjusted basis the precious metal is lower today than it was in 2011 and in 1980.

Given this, what can we conclude?

Since 1950 the U.S. Dollar has devalued by 90%. Our government will continue to devalue our currency over time. Cash provides short-term liquidity. It is far more stable than gold, stocks or bonds. However, it is a terrible store of long-term value. Cash is a short-term solution.

Gold can hedge interest rate manipulation and devaluation of paper currency. However, gold is far more volatile than green dollar bills.

Gold can be a hedge against world-wide chaos. Although it seems that chaos happens with increasing regularity, it remains highly unpredictable.

There are pockets of time in which gold has been a very productive asset class.

However, the majority of time a properly diversified portfolio of good businesses has delivered better long-term performance. At a time when interest rates remain artificially low, businesses can provide better cash flow in the form of dividends.

Dave Sather is a CERTIFIED FINANCIAL PLANNER and the president of the Sather Financial Group, a fee-only investment management and strategic planning firm.

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

| Gold Prices – 100 Year Historical Chart | MacroTrends

Interactive chart of historical data for real (inflation-adjusted) gold prices per ounce back to 1915. The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis with today’s latest value. |