Using Occam’s Razor For Better Results

Recently, I received a call from Michael, a recent business school graduate. He wanted to discuss a valuation model he developed.

The spreadsheet was more than 750 lines with macros, pivot tables and limitless assumptions. It even incorporated some of the latest artificial intelligence features. Michael was proud of the depth and complexity of his creation.

However, he was surprised when I asked him to summarize his inputs and results in one page or less. I also asked if there were simpler methods for arriving at a similar conclusion. As he thought about this, he stammered and asked why.

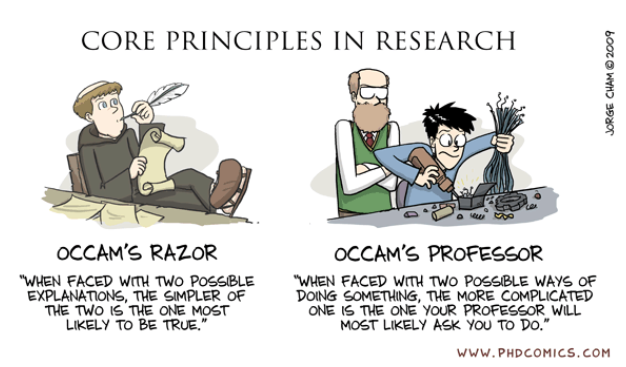

Occam’s Razor is a problem-solving principle that asserts that when faced with multiple ways of solving a problem, take the solution with the fewest assumptions. In a world awash with too many options, this is helpful in a variety of ways.

In our office, we embrace a mantra of, “If your answer takes until line 350 of a spreadsheet, you are making it too hard.”

Financial models can be very useful, but deceptive. Often, the longer the spreadsheet, the more variables which must be properly assessed. A small error rate compounds geometrically over time resulting in false precision.

At past Berkshire annual meetings, Warren Buffett and Charlie Munger were asked why academic programs don’t teach finance and investing the way they do. Munger would bluntly reply that if they focused on things that truly matter, universities and textbook companies would not have the volume of material to teach or books to sell.

Financial motivation leads me to believe many experts are compelled to deliver reams of data and analysis to justify fees—regardless of results. Imagine the look on a large client’s face when presented with a $100,000 fee but only one sheet of paper with a concise and effective answer. Rather, volumes of pages, graphs and charts typically accompany the sizable fee, even if the answer is less effective. Complexity and opaqueness sell consulting services and promotes academic literature.

When I was in graduate school it was common for consultants and academics to develop incredibly complex models. They would triumph that their particular model had a 92% accuracy rate, or some similar claim.

A good example of this complexity was in 1998 when Long Term Capital Management imploded. With two Nobel prize winners on their team, they were incredibly intelligent. However, their models were overwhelmingly complex with many inter-related variables including massive leverage.

LTCM had over $120 billion in assets when it cratered. However, due to borrowed money its credit exposure was so enormous the Federal Reserve was forced into action to prevent a world-wide collapse.

Buffett has often said if you have a business to sell, he can tell you if he is interested in five minutes. That statement used to confuse me. However, in studying his methods one realizes Buffett has filtered every possible question that could be asked, into the few that truly matter.

Buffett knows in providing downside protection a simpler model allows you to build a wider margin of safety. This allows him to be “approximately right as opposed to precisely wrong.” Again, more variables leads to increased complexity. This makes it geometrically harder to build a true safety cushion.

In addition to knowing which variables matter, Buffett puts the odds in his favor by extending time frames. Even if assumptions are 100% accurate, it does not mean markets agree with you. However, the longer you extend time frames, the higher the odds are the market will eventually appreciate your analysis.

As you build your own models, budgets or projections know the top five or ten variables or questions that really matter. Summarize your investment thesis in one page or less and then look in the mirror. Are you making it too hard? Are you being intellectually honest? Follow Occam’s Razor and identify the simpler solution. Not only will Occam’s Razor help you with financial matters, but it works for a variety of life’s challenges.

Be careful with leverage. Borrowed money makes us look smart when markets agree with us. However, it is wickedly painful when the market disagrees.

Give your investments enough time to succeed. The dividing line between zero and hero can be mere days, weeks or months. Why leave it to chance? Give your portfolio at least ten years to achieve maximum success.

Dave Sather is a Certified Financial Planner™ and the CEO of Sather Financial Group, a fee-only, strategic planning and investment management firm.