Warren Buffett & The Next Five Years

The last five years have delivered unprecedented challenges for financial markets and society.

There was the brutality of the worldwide COVID-19 pandemic. It is estimated that more than 700 million people contracted COVID-19 resulting in more than seven million deaths.

The reaction to COVID and the plummeting financial markets was to backstop the economy and flood the markets with cash. As such, it was no surprise when inflation spiked to more than 9%.

Flooding the market with such large sums of cash diluted the purchasing power of existing dollars by approximately 25% in a matter of months.

Inconceivably, as the demand for oil collapsed and supply surged, the price of oil went negative. It remains unfathomable to consider how this could happen.

There was a ripple effect in which the spike in interest rates triggered a run on Silicon Valley Bank, Signature Bank and First Republic Bank. Five sizable banks failed in 2023.

The Russia-Ukraine war is in its third year, while Hamas invaded Israel in October of 2023. The US continues a trade war with China and we have yet to see what the Trump tariffs will bring.

We have had interesting choices at the ballot box for President of the United States.

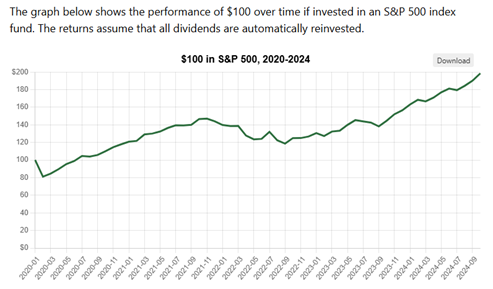

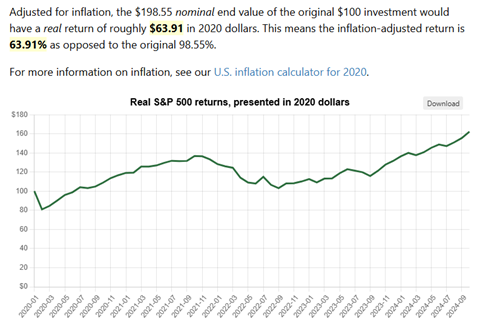

Despite this laundry list of chaos and insanity, the S&P 500 grew more than 15% per year, nearly doubling over this five-year period. It is also important to recognize the stock market outperformed the increase in inflation by more than ten percentage points per year.

Given this, what do you think the next five years will offer? More importantly, how will you react and invest?

A few things I have high certainty on. We will have a new President in four years and the Federal Reserve will continue to devalue our currency.

However, I have no idea what Federal Reserve interest rate policy will be nor what oil and gas markets will do. Even if I did know, I am not sure how I’d monetize this knowledge. I have no idea what cryptocurrency or gold will do.

Fortunately, Warren Buffett’s annual letter just came out offering wisdom and guidance. (https://www.berkshirehathaway.com/letters/2024ltr.pdf )

In perusing Berkshire Hathaway’s annual report, a year ago, Buffett’s company sat on cash and equivalents of $167 billion. Today, that figure is $334 billion. Many speculate Buffett is going to cash in preparation for a crash. This requires deeper analysis.

Much of this cash came from one single holding—Apple. When Buffett began buying Apple it traded for ten times earnings. He significantly trimmed the position at thirty-five times earnings. That is a logical thing to do.

In the annual letter, Buffett acknowledged the value of publicly traded stocks held by Berkshire declined last year. He also offered that Berkshire owns 189 companies outright including GEICO, Precision Castparts, Dairy Queen, BNSF Railroad, Pilot Travel Centers, Clayton Homes, and Fruit of the Loom.

In addressing these, Buffett said, “While our ownership in marketable equities moved downward last year from $354 billion to $272 billion, the value of our non-quoted controlled equities increased somewhat and remains far greater than the value of the marketable portfolio.”

The 94-year-old added, “Berkshire shareholders can rest assured we will forever deploy a substantial majority of their money in equities – mostly American equities although many of these will have international operations of significance.”

Buffett continued, “Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned.”

“Paper money can see its value evaporate if fiscal folly prevails,” he added. “In some countries, this reckless practice has become habitual, and, in our country’s short history, the U.S. has come close to the edge. Fixed-coupon bonds provide no protection against runaway currency.“

“Businesses, as well as individuals with desired talents, however, will usually find a way to cope with monetary instability as long as their goods or services are desired by the country’s citizenry,” Buffett said. “I have depended on the success of American businesses, and I will continue to do so.”

Five years from now, capitalism will continue to be the tide that lifts the most boats. Buffett is clearly saying if you want your assets to grow net of taxes, inflation, currency devaluation and other frictional expenses, business ownership remains the best method.

It will be interesting to see where the greatest nation on the planet sits in another five years.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a fiduciary fee-only investment manager and strategic planning firm.