What Is The Market Telling Us?

With the market down more than 1,800 points in two days, Mitch called and asked, “What do you think the market is telling us?”

I replied that if he wanted quick cash, he could get it but it would be at a 5% discount to what it would have been last week.

He did not like my answer.

I elaborated that although the talking heads on the financial news prognosticate with great authority about what is going on, they don’t know—and neither do I.

The only thing we know with great certainty is that markets offer liquidity. If you want to quickly convert part of your portfolio to cash, the stock market will accommodate.

Sometimes it is at favorable prices and other times the market demands a discount for quick access to cash.

Mitch seemed a bit skeptical.

I added that the stock market is no different than any other market. He asked what I meant.

If you go to the auto auction, there are people trading cars. Sometimes supply overwhelms demand and prices drop. The same is true for the cattle auction or eBay. People bring inventory to exchange for cash. Other people bring cash to exchange for inventory.

However, when the auto auction or the cattle market offers prices that are not to your liking, the smart asset manager holds his inventory until prices stabilize.

Whether dealing with real estate, gold, guns, oil wells or any other asset, the quicker you need cash the more at risk you are for receiving a big discount to the fair value you might receive if you were patient, disciplined and logical.

As we discussed this, I asked Mitch to think about someone walking into a pawn shop at 2 a.m. If you demand cash on the spur of the moment for a $2,000 rifle, you are playing a weak hand. Maybe you’ll get $1,000—a 50% discount. No one expects a pawn shop to pay top dollar in the first place. They certainly won’t in the dead of the night.

Similarly, stock markets do not offer a full and fair valuation service. They do not go out and methodically evaluate assets such as buildings, factories, equipment, technology or intellectual property. They do not evaluate the sales or earning ability of a business over a long period of time.

Instead, they give an indication as to what a given business can be sold for at that exact moment.

For this reason, when we take on a client who is going to own stocks we make them look us in the eye and commit to leaving the money invested for a long time frame—preferably ten or more years. If they are looking to liquidate their portfolio over any short time frame, the results will be erratic and chaotic. As such, a short-term seller puts themselves at great risk for a bad outcome.

Although Mitch saw my point, he persisted. He said, “Yeah, don’t you think 1,800 points in two days is a bit extreme?”

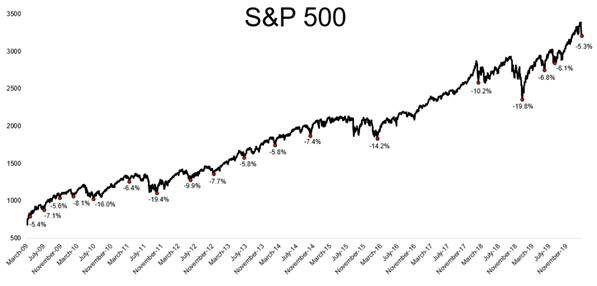

I shrugged my shoulders and said it is pretty typical. An 1,800-point drop is about 5%. Since March of 2009 the market has fallen by 5% on eighteen occasions and five of these were drops of more than 10%.

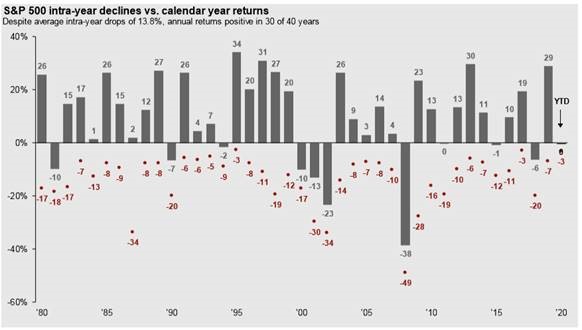

Furthermore, over the past 40 years the stock market falls by 14% intra-year, on average. This is a result of people seeking immediate liquidity—not because the ability of business has truly been impaired.

Although we are discussing the impact of the coronavirus today, there is always something to be concerned with over a short time frame. As such, if you are demanding high valuation you need to wait for the right day. Markets must be positive and the smart investor must be extremely patient and disciplined.

Otherwise, the smart investor sets aside a minimum of nine months of spending needs in liquid assets to deal with emergencies. This insulates them and prevents them from having to sell their most productive assets at fire sale prices.

Dave Sather is a Certified Financial Planner™ and owner of Sather Financial Group. His column, Money Matters, publishes every other week.