What Will Biden Inherit?

Life in the pandemic has offered long stretches of mind-numbing boredom followed by bursts of intensity and chaos. The first half of November has certainly offered plenty of extremes also.

The national election delivered record voter turnout while the race for control of the senate remains in limbo.

Assuming Joe Biden is sworn in as president, what will he inherit?

The contested senate race in North Carolina has been called for the Republicans giving the GOP a slight edge. However, we won’t know who controls the Senate until after the January 5th runoff in Georgia.

Although the Republicans hold a slight lead in the Senate, it should prompt an evaluation of your tax and financial planning matters this year, and again, after the Senate race is finished.

November also brought news that Pfizer’s coronavirus vaccine appears to deliver better than 90% efficacy while Eli Lilly has developed an antibody treatment for those with the coronavirus. Additionally, there are eleven Covid-19 vaccine candidates in Phase III testing.

If Pfizer comes through, this will be the fastest a vaccine has ever been created in the history of the world. This is great news for society!

Whether you compare this to the moon landing, 9/11 or some other significant event, this type of news will forever be seared into our minds. However, we are not out of the woods yet and investors need to stay vigilant.

In the first six weeks of the coronavirus, our government increased the federal deficit more than the previous five recessions combined. Furthermore, the Federal Reserve bought more U.S. Treasury debt than they had in the prior nine years.

With the benefit of hindsight, if I ran the Treasury or Fed I am not sure what I would have done differently. However, there are consequences for these actions.

Foreigners are starting to unload U.S. Treasury debt and the U.S. Dollar is weakening. They are not crashing, but it warrants attention.

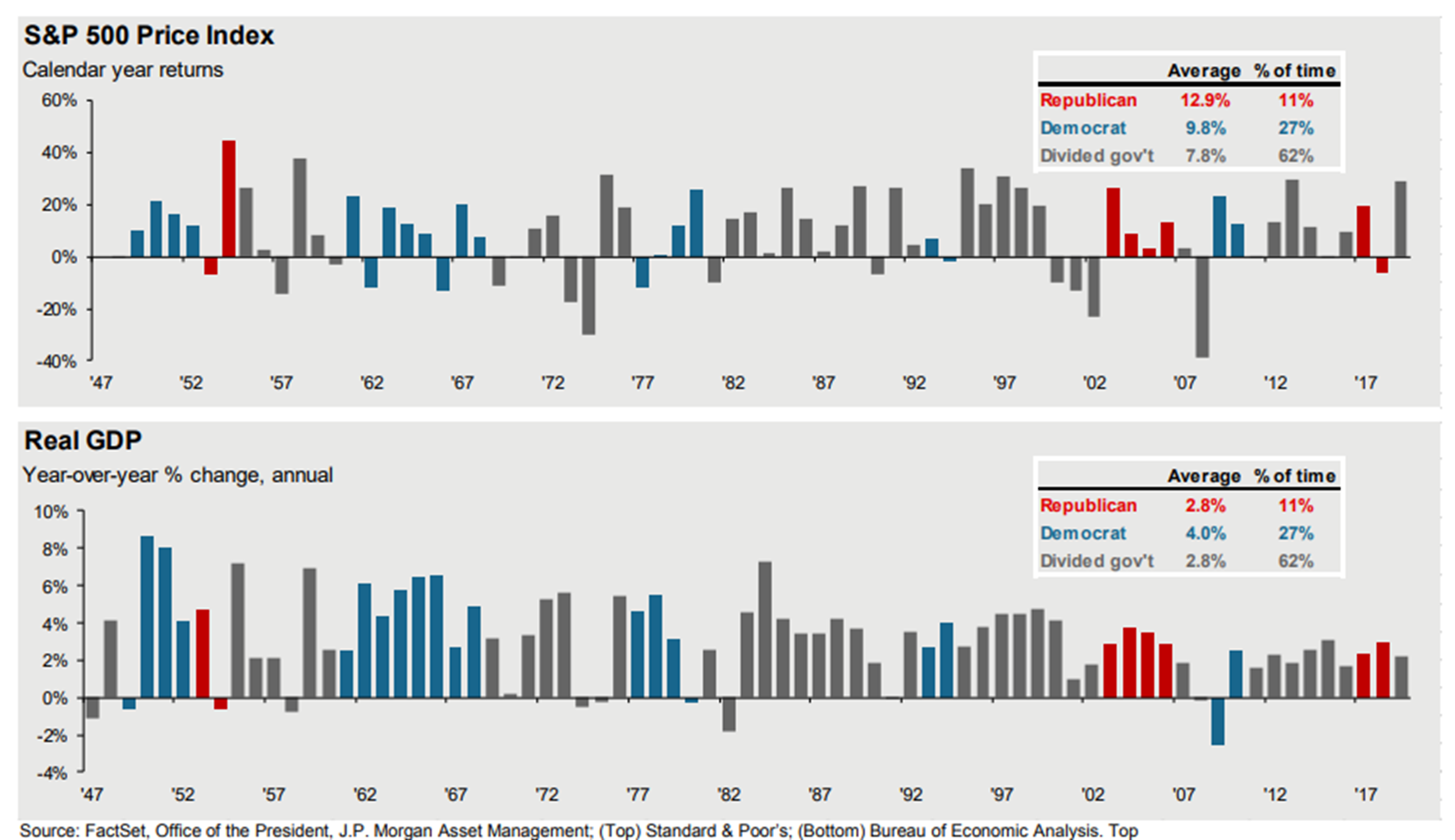

The last thirty years of Republican and Democrat Administrations have shown that federal deficits will continue to get larger.

Interest rates will probably stay low for quite some time. Fixed income assets offer little in the way of capital appreciation and even less in terms of interest income. Fixed income investments will be severely challenged to outpace taxes and inflation. As such, the “safe” investment will continue to lose purchasing power.

Low rates will allow many “zombie” companies to survive longer than normal in a typical economic cycle. Average global high yield debt currently pays 4.9% interest. It is amazing to think that a junk-rated company can borrow so cheaply.

An era of big government will continue to benefit financial assets—especially those invested in large companies. Large companies have the resources to employ lawyers and lobbyists. This allows regulation and legislation to be manipulated which derives favorable terms in the process.

On the other hand, small businesses get funding from banks at a time when banks are stingy on offering credit. This makes it much harder for small businesses to grow. Many small businesses will struggle with the increased burden of regulation.

It will be necessary for government assistance to continue. More bailouts, handouts and stimulus will be offered from sycophant politicians attempting to buy votes.

Regardless of the type of stimulus offered, there will be pockets of inflation. Official inflation is running at less than 2%. However, if you are shopping for things such as healthcare or used cars, the inflation rate is closer to 6%.

Depending upon the audience, when you mention “inflation” some have Jimmy Carter flashbacks with inflation rates in the teens. The economy is not strong enough to warrant that today. Rather, inflation might be meaningful in the 4% to 5% range.

The pandemic has accelerated technological shifts and trends that were under way. However, the pandemic forced five years of technology spending into six months. Wise investors will be careful as the momentum associated with these trends can quickly lose steam.

Lastly, the Biden Administration will inherit an economy with 6.9% unemployment. Since February there have been more than 10 million jobs lost. And yet, at the same time, there are 6.4 million job openings.

Investors will be challenged to generate a meaningful return from fixed income assets. Think of these assets as a return of your principal instead of a return on your principal.

Despite the volatility, the heavy lifting for the next decade will continue to come from stocks. They appear to be the asset class most likely to generate a net return in excess of taxes and inflation. Furthermore, stocks give an investor an opportunity to offset devaluation of the US dollar. Lastly, with interest rates so low, stocks can offer an increasing stream of tax-advantaged cash flows from dividends.