What Will Happen Over The Next Decade

With the 2010’s in the record books, my crystal ball has some interesting predictions for the next decade. As you read this, think about how you will react. What will you do with your portfolio? How will you manage your life? You need a plan so you can be logically proactive, as opposed to emotionally reactive.

- We will have an energy crisis. The price of oil will skyrocket 60% in a year. Crude will drop 75% over 18 months. There will be a subsequent 165% increase in the price of oil over 30 months.

- The climate will be in crisis.

- The U.S.’s standing in the world will be questioned. Republicans and Democrats will be at each other’s throats. Opposing politicians will blindly attack the President.

- Politicians will overreact and battle all previous crisis’s with little consideration for rapidly approaching threats.

- There will be threats of nuclear war.

- We will deal with financial crisis.

- The National Debt will double.

- Purchasing power of the dollar will erode.

- Interest rates will be volatile.

- Inflation will increase your cost of operation. Interest income minus taxes and inflation will produce guaranteed negative rates of return.

- Pedigreed financial experts will loudly sound the recession alarm bells.

- People on social media will embellish how good their life is while attacking those with opposing views.

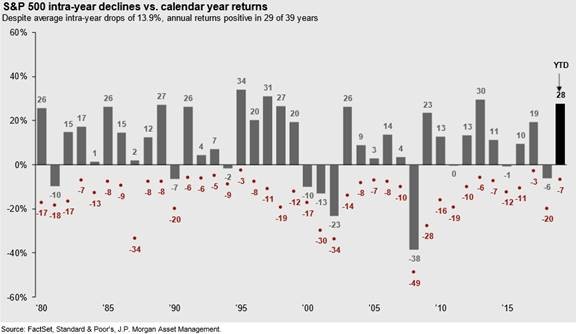

- Greed will cause investors to chase dangerous ideas. Fear will cause investors to ignore obvious opportunities. Investors will overestimate their tolerance for volatility when markets are going up, while being overly conservative when markets decline.

- Financial institutions will lend more money than you need. Incurring too much debt will limit investors ability for flexibility.

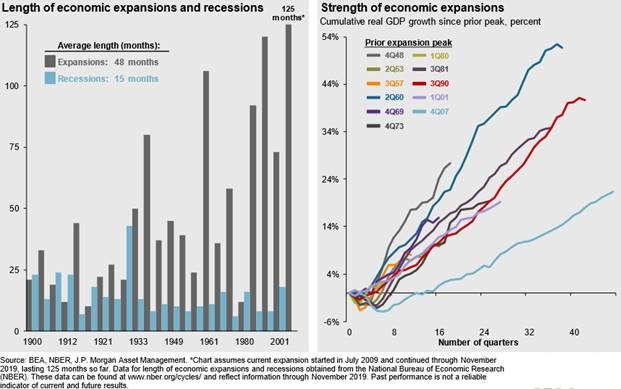

Most people recognize these things actually happened over the past decade. And yet, despite all of these scary events, life goes on…as does progress. Over the same decade:

- Gross Domestic Product, the sum of all goods and services bought and sold in the U.S., increased more than 45%.

- Unemployment fell from nearly 10% to 3.5%. It stands at the lowest level in fifty years benefitting all races, ethnicities and educational levels.

- Household income grew by 41% and compensation earned by employees grew by 50%. Those with the lowest levels of training experienced the highest wage growth rates.

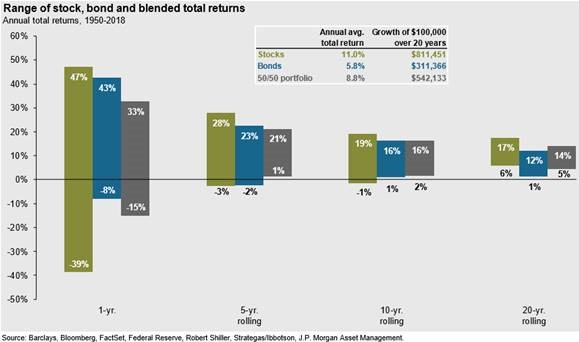

- The 10-Year US Treasury paid less than 4% interest per year for the decade. Lending money to the U.S. government for the next ten years will pay 1.9% annual interest.

- Inflation remains modest. Over the last decade inflation vacillated between 1.25% and 2.6%. It is currently 1.7%.

- Cash and fixed income investments fail to maintain purchasing power.

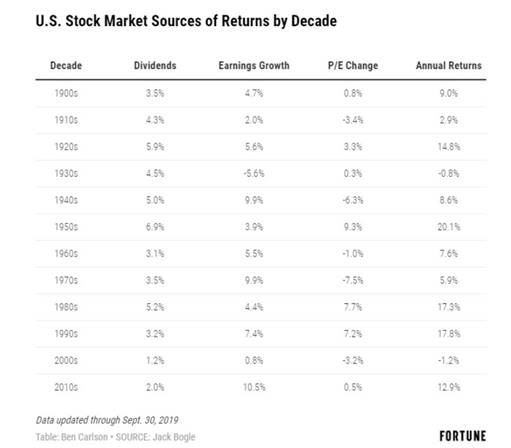

- Earnings per share of the S&P 500 increased more than 165%.

- Dividends per share by the S&P 500 increased more than 150%. The current dividend yield of stocks is 1.78%. However, dividends paid has doubled over the last decade. As companies are profitable, they typically increase dividends.

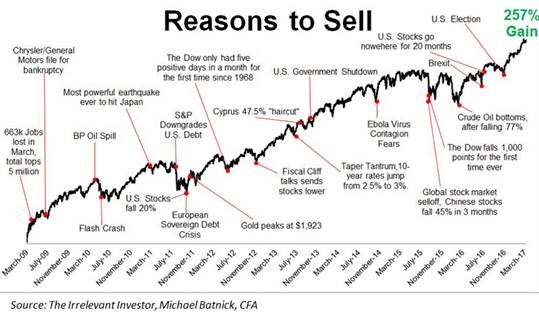

- Over the last decade, stocks were up nine out of ten years, for a total gain of more than 200%.

I have no idea what will happen in the next decade. There will be scary moments. Despite the fright and negativity, we will move forward. However, it won’t be even or readily apparent.

Recognizing this, know that no one can live your life but you. Know the consequences of your actions.

Don’t buy on the spur of the moment. The larger the potential purchase, the longer you should wait, before pulling the trigger.

Don’t worry about macroeconomics. Even if you accurately guess future interest rates, inflation, oil or any other macro-economic issues, it does not mean you can accurately handicap associated investing opportunities.

There will always be a prediction of a recession or other calamity. Although this sells advertising, it is not particularly helpful in making intelligent decisions.

Make decisions based upon data and logic. The hype and hyperbole of the media will only serve to depress and distract you.

Focus on things that are important and within your control.

Be a disciplined investor. Save and invest regularly in all markets over the next decade.

Capitalism may not distribute even or equal benefits, but it gives everyone a seat at the table. If you are willing and able to save and invest, capitalism is the tide that lifts all boats.

Dave Sather is a Certified Financial Planner™ and owner of Sather Financial Group. His column, Money Matters, publishes every other week.