Who Pays Federal Taxes?

The presidential election is just around the corner with the rhetoric as intense as ever.

In discussing this with my Texas Lutheran University students, Jenna asked what I thought about the claim that billionaires and corporations pay no taxes or pay less than schoolteachers or nurses.

It is a fair question and one most of us have heard. Unfortunately, our political system has devolved to making half-baked accusations around these topics.

Most American’s believe in a progressive tax system in which those that do well, pay more in taxes. And when we’re told that is not happening, we feel the system is rigged or those at the top are cheating. In an election season, this is effective at agitating and stoking class warfare.

Fortunately, there are some broad studies that do a decent job of painting a more complete picture.

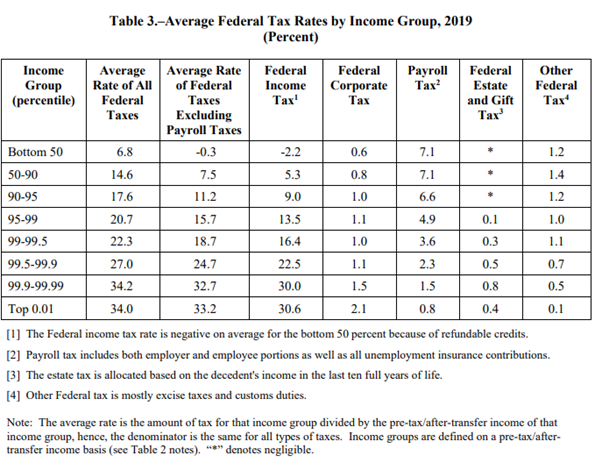

As we discussed this, William spoke up sharing the September 10, 2024, publication by the non-partisan Joint Committee on Taxation. He shared a table showing the bottom half of income earners pay a negative 2.2% tax rate, meaning they get money back from tax refunds and credits.

Will added that those in the 50th to 90th percentiles pay an average federal income tax rate of 5.3% while those fortunate enough to be between the 90th and 99th percentiles pay an average of 16.4%. As we processed this information, William finished by saying, “And if you are so successful as to be in the top .01%, you pay an average federal income tax rate of 30.6%.”

As Pablo studied the Joint Committee on Taxation report, he commented that wealthy people have a higher percentage of assets that produce capital gains and qualified dividends. He added that the maximum tax paid on capital gains and qualified dividends are 20%.

Some may argue that this low rate unfairly benefits the wealthy.

There are a few things to remember here, too. First, a married couple with income below $94,000 pay zero tax on realized capital gains and dividends. Secondly, a married couple with income below $583,000 pay a 15% tax while those above $583,000 in earnings pay a 20% rate on capital gains and dividends.

As with ordinary income, wealthy taxpayers pay a much higher rate on capital gains and dividends.

Furthermore, recognize that before corporations can pay a dividend, they must earn money. Earnings are taxed, generally at a 21% rate for a C-Corporation. The 21% rate is very close to the world average corporate tax rate of 23.5%. It is helpful to understand that if rates are too high in the US, corporations redirect expansion projects and hiring to more efficient nations.

From this, we can make a variety of observations.

Fair taxation has no definition, however, those making more money, are paying substantially higher taxes. There will always be an exception which is exploited by politicians to make it seem different or unfair. In discussing this, I recommended that my students read the book Factfulness by Hans Rosling.

Politicians who claim that billionaires and corporations don’t pay taxes either misunderstand the facts or are simply saying anything to get elected.

Although politicians pass legislation that creates our tax code, it doesn’t mean they understand it. Don’t take tax advice from politicians.

No one is claiming that wealthy people or corporations are cheating on taxes. Furthermore, corporations owe an obligation to shareholders to pay their tax owed, and not a penny more. If politicians are unhappy with the tax code, they should change it. The tax code has been pieced together over decades by politicians.

Corporations are owned by shareholders from all walks of life. Shareholders put money at risk to invest in businesses while expecting to earn a return justifying the risk. If corporations are not profitable, people stop putting money at risk and capitalism falls apart. Hopefully, all corporations are highly successful and profitable. Otherwise, people don’t have jobs.

Dividends suffer from double taxation, once at the corporate level and again at the individual level.

Wealthy people who earn capital gains and dividends pay a tax rate significantly higher than those at the low end of the economic spectrum.

As we finished class, my TLU students concluded that our tax system is unnecessarily confusing and complicated. However, each hoped they would have the privilege of being in the highest tax brackets one day. Although the benefits of capitalism are uneven, it is the system that offers the best opportunities for the most people.

Dave Sather is a Certified Financial Planner and the CEO of the Sather Financial Group, a “fee-only” strategic planning and investment management firm.